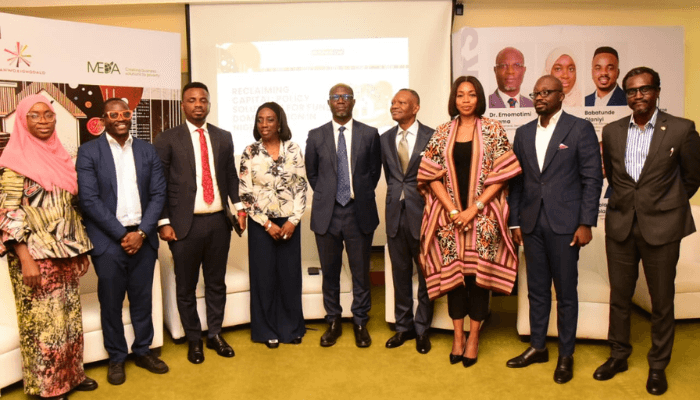

L-R: Aziza Muse-Sadiq – Partner, Banwo & Ighodalo; Dipo Okuribido – Senior Vice President, Legal, Verode Capital Management; Babatunde Olaniyi – Technical Adviser, President's Committee on Fiscal Policy and Tax Reform; Gwen Abiola-Oloke – Associate for Fund Domicile in Africa; Dr. Imomotimi Agama – Director General, Securities and Exchange Commission; Frank Agbogun – Publisher, Businessday; Chizoba Emmanuel-Avaksian – COO, Impact Investors Foundation; Akinbola Akintola – Head of Investor Relations and Research, PenOp; Akinwande Pierce – Technical Advisor, GIZ Nigeria

On Tuesday, 23 September 2025, the Legal Business Unit of BusinessDay Media Limited, in partnership with Impact Investors Foundation, hosted a Policy Roundtable Intervention Series on “Recovery Capital: Policy Solutions for Fund Domicile in Nigeria” at the Radisson Blu, Victoria Island, Lagos.

release

Released in the BusinessDay Policy Roundtable Intervention Series in partnership with the Impact Investors Foundation (IIF) and the Nigerian NABII.

Preface

We, participants in the BusinessDay Policy Roundtable Intervention Series on “Recovering Capital: Policy Solutions for Fund Domicile in Nigeria”, comprising regulators, fund managers, tax and legal experts, private sector leaders, professional service providers and development partners, on the urgent challenge of capital flight and practical reforms needed to strengthen Nigeria's ability to attract and retain investment funds within its borders. Gathered to discuss.

The Forum recognized Nigeria's huge human and natural capital base, along with growing household savings and pension funds. Yet, a significant portion of investable funds are structured and domiciled overseas, depriving the country of jobs, tax revenues and opportunities to deepen its financial markets.

Keynote speakers and contributions

The policy series was sparked by the presence of Dr. Imomotimi Agama, PhD, Director General of the Securities Exchange Commission (SEC), who highlighted the wide-ranging reforms undertaken by the regulator under his watch, assuring stakeholders of continued dialogue and engagement to deepen the country’s financial market.

Other speakers/panelists included:

1. Dipo Okuribido, Senior Vice President, Legal at Veroid Capital Management

2. Aziza Muse-Sadiq, Partner, Banwo & Ighodalo

3. Babatunde Olaniyi, Technical Adviser, President's Committee on Fiscal Policy and Tax Reform

4. Akinbonola Akintola, Head of Investor Relations and Research at PenOp

5. Akinwande Pierce, Technical Advisor, GIZ Nigeria

6. Gwen Abiola-Oloke, CEO of De Africa and member of the Collaboration for Fund Domicile in Africa, who also served as panel moderator.

Major issues observed

1. Capital flight and missed opportunities: Offshore domiciles continue to channel resources abroad, financing development elsewhere while Nigeria faces significant infrastructure and industrial deficits.

2. Tax Environment: Historical challenges such as aggressive tax enforcement, ambiguity in laws and administrative hurdles have reduced investor confidence. Although the reforms – which include 2024 withholding tax regulations through newly enacted tax reforms scheduled for January 1, 2026, reduction in the corporate tax rate (from 30% to 25%), higher MSME exemption limits, and priority-sector tax holidays – are positive, gaps in investor communications and forecasts remain.

3. Regulatory Fragmentation: Overlap between regulators (e.g., SEC and PenCom) and inconsistent rules on private equity, fund registration limits, and investment limits create uncertainty and increase compliance costs.

4. Lack of governance and trust: Weak dispute resolution, vague interpretations of laws (such as section 168 of the ISA), and sudden regulatory changes discourage long-term capital commitment.

5. Global Competitiveness: Nigeria lags behind peers such as Mauritius and South Africa in tax treaties, regulatory clarity and operational stability, reducing its attractiveness for international investors.

6. Retail Capital and Informal Savings: A significant pool of retail funds remains unstructured, leaving citizens exposed to Ponzi schemes, while formal markets underperform in mobilizing grassroots capital.

7. Overseas Fund: Despite $20+ billion in remittances annually, Nigeria has not created efficient vehicles to convert the flow of diaspora into productive, domiciled investments.

8. Gaps in Business and Legal Ecosystem: Constraints on fund managers (for example, stringent fee limits), unclear clearance versus registration procedures, and insufficient legal certainty limit the growth of a robust domestic fund management industry.

Recommendations after discussion

1. Increase fiscal and tax competitiveness: Fully implement and promote ongoing tax reforms to improve clarity and reduce unpredictability; Implementing advanced tax rulings to give investors certainty before deploying capital.

2. Strengthen Regulatory Coordination: Establish mechanisms for coordination among the SEC, PENCOM, CBN, and FIRS to eliminate duplication, resolve inconsistencies, and improve ease of fund registration and compliance.

3. Deepen legal and dispute resolution frameworks: Expand special financial dispute resolution mechanisms and ensure clear drafting of laws and regulations to avoid ambiguity that undermines trust.

4. Encourage Domestic Domicile: Introduce targeted incentives (tax credits, low capital gains on reinvested income, FX guarantees) that make Nigeria more attractive than offshore jurisdictions.

5. Assistance in raising retail capital: Formalize indigenous savings schemes (esusu/ajo) and expand financial literacy campaigns to build confidence in formal investment channels.

6. Expand Pension and Institutional Participation: Encourage pension funds and institutional investors to deploy more capital in locally domiciled funds, supported by clear risk and governance frameworks.

7. Take Advantage of Overseas Investment: Develop dedicated diaspora bonds, funds and co-investment vehicles that provide safe and transparent avenues for Nigerians abroad to invest at home.

8. Rationalize incentives for priority sectors: Align tax incentives (10-15 year tax holidays) with sectors critical to national development, ensuring that incentives are transparent, accessible and not arbitrarily withdrawn.

9. Commercializing the Ecosystem: Review strict fee limits and compliance burdens to allow fund managers to continue to grow, while balancing investor protection with market competitiveness.

10. Launch a new capital markets master plan (2026-2036): Build on the concluded 2015-2025 plan, incorporating Fund domicile, digital innovation, regulatory harmony and ecosystem development as central pillars.

conclusion

The Forum concluded that reclaiming and domiciliating Nigeria's capital is a national priority that requires deliberate policy coherence, fiscal reforms and confidence building between regulators and investors. With coordinated action, Nigeria can stem capital flight, unlock domestic and diaspora funds, deepen its financial markets and emerge as a competitive African financial centre.

We reaffirm our collective commitment to continue dialogue and collaboration with regulators and policymakers to transform these recommendations into actionable reforms that will promote sustainable growth, create jobs and strengthen Nigeria's economic sovereignty.

Released today September 23, 2025

At Radisson Blu, Victoria Island, Lagos.

A release prepared by Wasiu Alli, Head of Companies and Markets Desk at BusinessDay Nigeria