Nigeria's oil and gas industry is set for another wave of asset sales. At least 10 onshore and shallow water oil blocks, with an estimated potential of two billion barrels of oil equivalent, are up for potential disinvestment, according to BusinessDay findings.

International oil companies (IOC) and Nigerian National Petroleum Company Limited (NNPC) are preparing to sell mature onshore and marshy assets as they double down on offshore and deepwater operations, data from a new report by Renaissance Capital Africa shows.

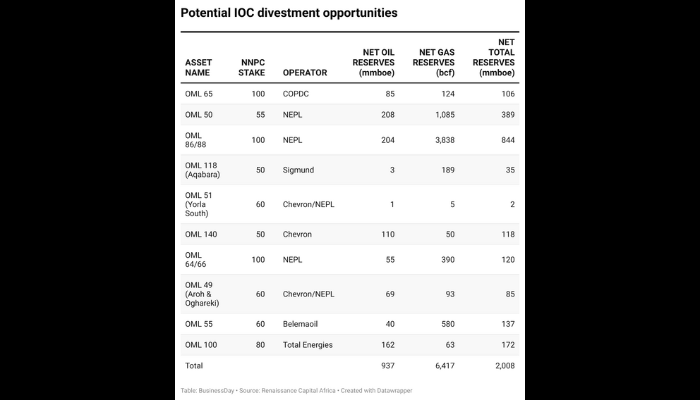

“Looking ahead, we anticipate further disinvestment by IOC and NNPC JV, where we see a significant opportunity for local E&P players to acquire 10 oil wells containing 2,008 MMboe,” Renaissance Capital said, citing industry engagement data.

Also read: Senate to tackle challenges in downstream oil sector

Potential assets include blocks operated by Chevron, TotalEnergies and NNPC's exploration subsidiary NEPL, spread across the prolific Niger Delta.

These include OMLs 49, 50, 51, 55, 64/66, 65, 86/88, 100, 118 (Agbara), and 140. These have a total of 937 million barrels of oil reserves and 6.4 trillion cubic feet of gas.

Indigenous players are ready to dominate

Analysts say the upcoming divestment marks the third major phase of ownership change in Nigeria's oil industry, after a decade of piecemeal IOC exits that transferred billions of dollars of assets to local companies such as Ardell Holdings, Seplet Energy, Heirs Holdings and ND Western.

“Indigenous and regionally focused E&Ps have acquired assets worth over USD7 billion in Nigeria alone since 2020,” said the report titled ‘Nigeria Oil & Gas: Recovery on the Horizon’. “Following the acquisition of these waterfront properties, local vandalism and theft have decreased significantly.”

Renaissance Capital said that after decades of underinvestment, the shift to local ownership is helping to unlock new capital and operational flexibility.

It says, “Airadell, SEPLAT, Heirs, ND Western and others are injecting new capital into drilling, well re-entries and field development programs that could expand their scale.”

The move is expected to consolidate Nigeria's transition to a 'locally dominated' onshore oil sector, while IOCs focus on lower-risk, capital-intensive deepwater assets. Offshore and deep offshore operations accounted for 55 percent of national production in 2024, while land and wetlands accounted for 45 percent.

Why are IOCs pulling out?

According to Renaissance, the reasons behind the exodus are clear: “ESG considerations, a pre-determined investment lifecycle, and a difficult operating environment.”

“Many IOCs are committed to the World Bank's Zero Routine Flaring initiative and reporting requirements from the Securities and Exchange Commission,” it added. “Mature O&G assets are no longer dependent on foreign investment and technological capabilities.”

Also read: Oil prices rise 5% as US imposes sanctions on Russian companies Rosneft, Lukoil

Security concerns have also loomed large. “Transmission losses from production stations to terminals were as high as 90% at their peak in FY 2020-24,” the report said, referring to large-scale oil theft.

Another factor is policy clarity. The Petroleum Industry Act (PIA) of 2021 finally gave investors 'free entry and exit', replacing the bureaucracy that once delayed asset transfers.

“Improved regulations enabled entry and exit of investors in the upstream business (PIA, 2021),” the report said.

Several recent transactions, including the $2.4 billion sale of Shell Petroleum Development Company (SPDC) to Renaissance Energy Group and the $1.58 billion acquisition of Mobil Producing Nigeria Unlimited by Seplat, were structured as leveraged buyouts.

“Produced oil is the security of a loan issued by the seller to the buyer, then paid as crude oil is delivered to the seller,” Renaissance said.

Ten new disinvestment targets

Of the 10 disinvestment candidates listed by the firm, some are wholly owned by NNPC subsidiaries and others are jointly operated with Chevron and TotalEnergies.

They include: OML 65 (COPDC) – 85 MMboe oil reserves; OML 50 (NEPL) – 208 MMboe of oil, 1,085 Bcf of gas; OML 86/88 (NEPL) – 204 MMboe of oil, 3,838 Bcf of gas; OML 118 (Agbara, Sigmund) – 3 MMboe of oil, 189 Bcf of gas; OML 51 (Yorla South, Chevron/NEPL) – 1 MMboe oil; OML 140 (Chevron) – 110 MMboe of oil; OML 64/66 (NEPL) – 55 MMboe oil, 390 Bcf gas; OML 49 (Chevron/NEPL) – 69 MMboe of oil, 93 Bcf of gas; OML 55 (Bellemaoil) – 40 MMboe of oil, 580 Bcf of gas; OML 100 (Total Energy) – 162 MMboe of oil

Together, these blocks represent what Renaissance calls a “credible pipeline for the next phase of local M&A.”

The company said they offer “bankable projects to investors and local commercial banks”, with indigenous players now able to access local funding sources instead of relying solely on offshore lenders.

“The share of O&G-specific assets in the loan book of local commercial banks is around 30%,” it said. “In our view, this may increase following IOC's disinvestment in indigenous E&P.”

next wave financing

Financing capacity has long been a barrier for Nigerian independents, but Renaissance said the new phase of the transaction will benefit from sophisticated financing structures and improved governance.

“Funding considerations have been refined since the first round of IOC disinvestment given the historically rising sector NPLs,” it said. “Due diligence now includes an ESG action plan, evidence of reputable off-takers and monthly production reports to inform repayment capacity.”

Also read: Local operators now account for over 30% of Nigeria's oil production -NUPRC

The report cites Ondo's $375 million reserve-based loan facility from Afreximbank as an example of how structured finance is evolving to support local operators.

NNPC, which has been transformed into a commercial entity under PIA, is also expected to rationalize its portfolio ahead of a possible initial public offering. “The medium-term focus will be on asset rationalization and administration ahead of a potential IPO,” Renaissance said. He said the company “has begun securing funds for growth” and has cleared long-pending cash call dues for its joint venture partners.

PIA has also empowered regulators to streamline approvals and attract investments. For example, the Reduction in Petroleum Sector Contract Cycle (RPSCC) Directive has reduced the approval time for oil field development plans to 30-45 days.

“This enables faster O&G project execution to meet medium-term crude and gas production targets,” Renaissance said.

Production recovery on track

Nigeria's oil production is slowly recovering from years of decline, the report said. “The active rig count is set to increase from 29 in January 2024 to 40 in September 2025, levels not seen in many years,” it said. “If sustained, this upward trend in drilling activity offers Nigeria a credible path to not only meeting but potentially exceeding medium-term production targets.”

The government aims to increase production to above two million barrels per day by fiscal year 2026, supported by PIA incentives and increasing domestic participation.

“The foundations for growth are being laid,” the report said. “If sustained, Nigeria can not only meet but potentially exceed medium-term production targets, reinforcing the story of a recovering and investable oil and gas sector.”

Midstream changes: Dangote and DCSO

Midstream development is also giving a new shape to this sector. The 650,000-bpd Dangote refinery is “a structural inflection point”, Renaissance said, with the domestic crude supply obligation (DCSO) ensuring a stable supply of local crude.

“The simple rule of 'no compliance, no export' turns the DCSO into more than a policy aspiration; it becomes an operational necessity,” the firm said. “By substituting imports with local output, the DCSO reduces FX outflows, helps stabilize the Naira, and smoothes inflationary pressures.”

According to IMF estimates cited in the report, the refinery is expected to improve Nigeria's current account by $5.5 billion annually.

Gas transition and long term outlook

The report also highlights Nigeria's huge untapped gas potential. With 193.3 trillion cubic feet of proven reserves, the country is among the world's top 10 in terms of reserves, but still lags behind in production. “Nigeria is one of the most gas-reserve countries in the world, but is not among the leading gas producers,” it said.

Projects such as the Ajaokuta-Kaduna-Kano (AKK) gas pipeline, now 84 percent complete, and NLNG's Train 7 expansion, are at the heart of Nigeria's 'Gas Decade' industrialization plan. “The AKK pipeline will be an enabler for domestic industrialization and gas-to-power projects in Abuja, Kaduna and Kano,” the report said.

Also read: Representatives launch probe into $850 billion unrepatriated crude oil export proceeds

cautious optimism

Despite the challenges, Renaissance said the outlook is 'broadly positive', supported by reforms and increasing investment momentum. It concluded, “The ongoing divestment of onshore and shallow water assets by the IOC to indigenous players is reshaping the upstream landscape.” “Continued execution on these fronts can position Nigeria’s petroleum industry for gradual but sustainable improvement in both production and value creation.”