When the Nigerian Electricity Regulatory Commission (NERC) unveiled a N28 billion bailout for power distribution companies last month, the announcement was met with both optimism and fatigue.

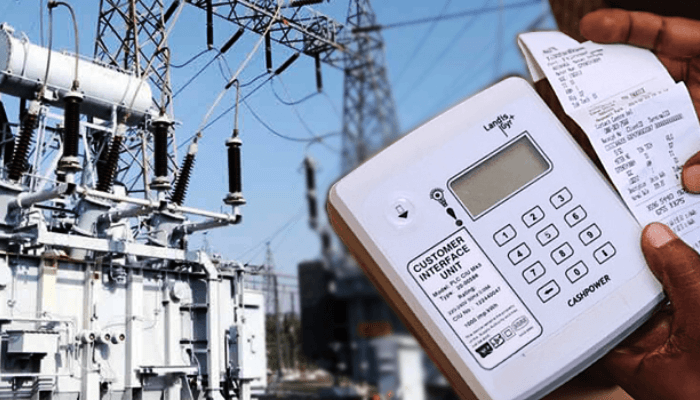

This amount has been earmarked to purchase and install meters at no cost to consumers in tariff bands A and B.

The move is part of the broader Presidential Metering Initiative (PMI), which aims to close the metering gap affecting an estimated seven million customers.

For government officials, it was a new effort to bridge the country's metering gap, which causes millions of households to be billed on estimated consumption. To the public, it seemed like déjà vu.

BusinessDay findings revealed that the fresh injection is being viewed cautiously by critics and power sector observers, who recall that about N1.5 trillion has already been pumped into metering programs over the years with little meaningful progress.

Although the government and multilateral partners claim to have spent this amount on various metering interventions, more than half of electricity customers are still unmetered and dependent on estimated bills.

Data obtained from NERC shows that as of June 30, 2025, only 6,422,933 out of 11,821,194 active registered electricity customers (54.3 per cent) in the twelve (12) Discos were given meters.

This implies that approximately 5.3 million electricity customers are still unmetered.

The N28 billion Meter Acquisition Fund (MAF) tranche announced on October 15 is aimed at financing the procurement and free delivery of meters to customers on the most critical supply categories, Bands A and B, who must enjoy the most reliable power supply.

Under the arrangement, funds collected from market revenues are being distributed among 12 distribution companies (DISCOs) as per their customer base and technical needs.

Ikeja Electric, Eko Electricity Distribution Company, Ibadan Electricity Distribution Company and Abuja Electricity Distribution Company are among the biggest beneficiaries who are expected to receive billions of naira to purchase and install new meters before the end of the year.

According to NERC, this latest bailout represents “a decisive measure to eliminate estimated billing and increase efficiency in electricity distribution.” But skepticism runs deep throughout the industry.

“The challenge is no longer about money, it is about delivery and honesty,” said a senior executive at a Lagos-based meter manufacturing firm, who requested anonymity for fear of regulatory backlash. “We've seen this movie before: money released, promises to install meters, and very little to show for it.”

That skepticism is well earned.

Since 2020, the federal government, through the Central Bank of Nigeria (CBN) and other agencies, has launched a number of programs, each of which is projected as a program that will eventually eliminate estimated billing. Yet, each is based on a combination of corruption, weak oversight, and bureaucratic inertia.

The National Mass Metering Program (NMMP) was the first of these grand interventions. Introduced in 2020, it came with ₦200 billion seed fund from the CBN and an ambitious plan to distribute one million meters in its pilot phase at a cost of N59.28 billion. The meters were to be supplied by local manufacturers registered as Meter Asset Providers (MAP).

By 2022, the project was mired in scandal. The CBN approached a High Court in Lokoja, seeking to freeze 157 bank accounts belonging to 10 companies that allegedly diverted NMMP funds. The apex bank accused the beneficiaries of investing the money in unrelated ventures.

Industry insiders told BusinessDay that the reason for the failure of the program was collusion between suppliers and officials of supervisory agencies. “Most of the meters were not supplied due to collusion between companies and government officials in the previous administration. The money was directly used,” a source said.

Of the planned one million meters, less than 940,000 were delivered, and even fewer were installed. Billions of Naira are unaccounted for.

Also read: Meters installed by Discos reach 225,631 in Q2 2025

Promise of “free meter”

Following the NMMP debacle, NERC introduced the Meter Acquisition Fund, earmarking ₦21 billion to distribute free meters to selected customers. But progress under the first phase has been slow.

A NERC document seen by BusinessDay shows that by June 2025, the discos have covered around 107,000 Band A customers through the MAF scheme.

The analyst said Discos, grappling with debt and poor cash flow, have little incentive to prioritize metering, as unmetered customers can be billed arbitrarily.

For many consumers, that system remains a source of frustration and distrust.

The Presidential Metering Initiative (PMI), launched later, was touted as a game-changer. The Federal and State Governments jointly allocated ₦700 billion with the goal of installing over 10 million meters across the country, eliminating arbitrary billing, restoring public confidence in the power sector and empowering consumers through accurate, transparent and fair electricity pricing.

By mid-2025, the Federal Government plans to deploy seven million smart electricity meters across the country through PMI, Olu Verheijen, Special Adviser to the President on Energy, said in Abuja as part of programs to commemorate the second anniversary of President Bola Tinubu's administration.

But two major Discos told BusinessDay that none of the meters had reached their warehouses.

A senior Disco official said, “Press statements are always ahead of reality.” “We read that meters were supposed to arrive, but we didn't get a single meter.”

ALSO READ: Delegates quiz NERC on ₦59bn metering fund

Paying Twice, Waiting Forever

Even customers who have tried to take over metering have faced hurdles. Under the Meter Asset Provider (MAP) scheme, introduced in 2018, consumers were allowed to pay for meters directly, with the understanding that they would be reimbursed through energy-usage credits over time.

“Of the 225,631 end-use customers metered in the first half of 2025, 147,823 (65.52%) customers were metered under the MAP framework,” NERC said in its latest report.

But electricity customers surveyed by BusinessDay said the result is widespread dissatisfaction. “It feels like we are being punished for doing the right thing,” said Chidinma Eze, a small business owner in Isolo, who paid ₦88,000 for a meter in 2022 and is yet to receive a refund. “Every new initiative becomes another excuse to raise money.”

The World Bank's Distribution Sector Recovery Program, which was intended to provide structure and international monitoring, has fared little better. The Bank approved a $500 million loan to Nigeria, with $155 million (about P100 billion) allocated for 3.2 million metres. But the effort has stalled due to disputes between local producers and the Transmission Company of Nigeria (TCN), which manages the fund.

Local companies accuse TCN of awarding contracts mainly to foreign suppliers, particularly two Chinese companies, which together secured deals worth about ₦100 million for 1.25 million metres. The controversy has left hundreds of thousands of planned installations in limbo.

According to estimates compiled from records of NERC, CBN and the Ministry of Power, the cumulative expenditure across these programmes, CBN loans, federal budget allocations, donor funds and state contributions now exceeds P1.5 trillion.

Yet, despite this huge outlay, Nigeria still has over seven million unmetered customers, according to the latest regulator data.

Analysts say its impact extends far beyond consumer billing. “Metering is the foundation of a viable electricity market,” said Ayodele Olawande, an independent energy economist based in Abuja. “Without accurate measurement, you can't price electricity fairly, you can't attract investors, and you can't enforce accountability.”

Continuity of estimated billing undermines both revenue collection and trust. This allows DISCOs to overbill customers during supply shortages, while depriving the electricity market of actual consumption data needed for planning and investment.

“It's not a problem of rules – it's a problem of political will,” said an industry consultant who worked on the last two programs. “Every new scheme uses the same old templates, old players and the same opaque accounting.”

Many manufacturers, especially indigenous firms, argue that the government's approach favors middlemen rather than producers. Some companies that participated in the first round of metering claim they are still owed billions of naira in payments.