Nigerian air travelers are facing the highest fares in Africa due to the burden of numerous taxes, duties and levies imposed by government agencies and regulators.

As the aviation market recovers from the COVID-19 recession, Nigeria has continued to increase taxes to offset the fiscal deficit, leading to higher operating costs for airlines and higher fares for passengers.

The most recent development is the introduction of an additional $11.5 fee per ticket by the Nigerian Civil Aviation Authority (NCAA) from December 1, 2025.

The new levy is apart from the $20 security levy introduced in 2010 by the apex body among the charges collected by the Federal Airports Authority of Nigeria (FAAN) and other aviation government agencies.

Also read: Why do airlines enforce phone usage rules for passengers – experts

This new tax, known as the Advanced Passenger Information System (APIS), aims to create a 'single window' approach for all agencies at the airport, and the collection is expected to last for 20 years.

The NCAA said the system would help track passenger movements, improve border control, and provide a cost-recovery mechanism to airlines for system maintenance.

NCAA said the initiative, which is in partnership with the Nigeria Immigration Service (NIS), will streamline passenger clearance at Nigerian airports by collecting and processing passenger data before arrival.

The memorandum states that, “APIS fee will be collected as point of sale and will be levied on all tickets issued from December 1, 2025 for every passenger departing from or arriving in Nigeria. The lifting airline is responsible for remitting the APIS fee to NCAA.”

“Therefore, all airlines (including Nigerian carriers) operating international flights in and out of Nigeria are required to take immediate steps to update ticketing and reservation systems to reflect the new APIS charges, as the charges for tickets issued to passengers traveling to Nigeria from 01DEC2025 onwards will commence from 1DECEMBER 2025.”

Apart from the challenges of sole ownership, poor governance, inadequate expertise and unsuitable aircraft, domestic airlines in Nigeria are also affected by the impact of unilateral taxes, duties and levies, which further harm their viability.

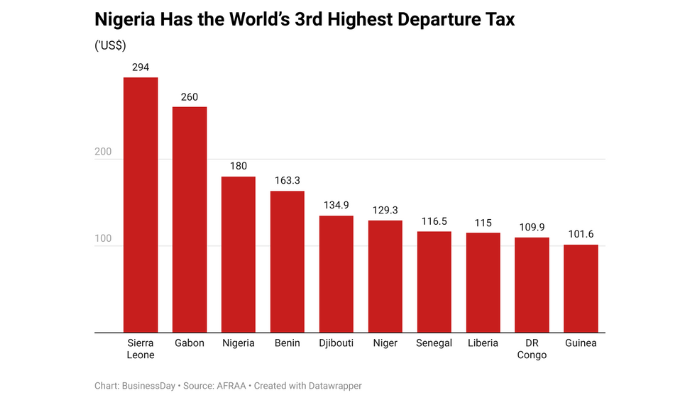

Nigeria is the third most expensive country in Africa in terms of ticket taxes at $180 per ticket, behind Gabon ($297.70) and Sierra Leone ($294), according to data from the African Airlines Association (AFRAA).

Meanwhile, industry stakeholders argue that government agencies continue to prioritize revenue generation without providing commensurate value.

Meanwhile, each flight, in turn, incurs other fees such as flight clearance, navigation, parking, or landing fees. Other personnel and equipment-specific fees, such as licensing, training, aircraft certification, insurance, etc., also apply.

These airlines still have to deal with operating expenses including fuel, maintenance and depreciation.

When taken in aggregate, the share of taxes in the gross revenue of domestic airlines is about 32.7 per cent, which is well above the global average.

The world average of airline profitability for major carriers of size and scope is between 1.5 percent – 2.5 percent.

Also read: Summer travel boosts global air passenger demand in July

voices of industry

Roland Iyayi, former managing director of the Nigerian Airspace Management Agency (NAMA) and CEO of Top Brass Aviation, said the argument that passengers – not airlines – bear the tax ignores the reality of pent-up demand.

“Who provides the capacity for passengers? Government or private airlines? Who suffers the loss when seats are vacated, assuming they are perishable? Is the demand suppressed by the increase in ticket price or not? Why are ticket prices not reduced in this country? So many questions, yet no answers.

“Having successfully destroyed the growth prospects of fixed-wing airline operations in the country, the focus has now shifted to rotary wing aircraft for the final stage destined for the end of the domestic industry,” Iyayi said.

In Africa, air travelers pay an average of 3.5 different taxes, fees and charges for international departures, representing an average of $68, according to the AFRAA Tax and Fees Study Review 2024.

Among the top 10 most expensive countries in terms of ticket taxes, charges and fees, Gabon ranks first with $297.7 taxes per international departure, followed by Sierra Leone with $294 taxes and Nigeria with $180 taxes. Niger, Benin and Ghana are also part of the list. The least expensive countries for international departure ticket taxes are Libya, Malawi, Lesotho and Algeria.

The list of 10 least expensive countries also includes Eswaani, Tunisia, Botswana, Morocco, Sao Tome, Angola and South Africa, which are countries with significant traffic. 19 out of 54 countries are above the continental average; 14 countries charge travelers more than $100 in fees in 2022, up from 13 in 2022. Twenty-six countries charge $50 or more.

Obikuvu Mbanuzuo, former chief commercial officer of Green Africa, gave further details of the taxes and surcharges.

According to him, on one-way tickets sold by airlines, they pay a certain percentage to the Federal Airports Authority of Nigeria (FAAN) and five percent to the Nigeria Civil Aviation Authority (NCAA) as passenger service charge.

ALSO READ: FG to force public officials to take Nigerian airlines abroad

He explained that out of whatever is left, the airline pays FAAN (through marketers) N2.50 for every liter of fuel plus landing fees, which depends on the landing weight of the aircraft.

He said that on each flight, the airlines pay between N20,000 and N25,000 per ticket to the Nigeria Airspace Management Agency (NAMA) as terminal navigation fee and route navigation fee to the handler, excluding other charges to the airports for space rental at check-in counters.