United Bank for Africa (UBA) Plc, Africa’s global bank, has announced its audited results for the third quarter ended September 30, 2025, where it recorded strong and impressive growth across all its key indicators.

In the first two quarters of the current financial year, the bank's gross earnings increased by 3.0 per cent to N2.469 trillion from N2.398 trillion recorded in September last year, while its net interest income which stood at N1.103 trillion at the end of the third quarter in 2024, increased by 6.2 per cent to N1.172 trillion in the period under consideration.

The bank's financial report filed on Thursday with the Nigerian Exchange Limited also indicated that profit before tax (PBT) declined marginally by 4.1 per cent to N578.59 billion compared to N603.48 recorded at the end of third quarter of 2024, while profit after tax increased by 2.3 per cent from N525.31 billion recorded a year earlier to end of September 2025. increased to N537.53 billion.

Like the last two quarters this year, UBA has maintained a very strong balance sheet, with total assets growing to N32.492 trillion, representing an increase of 7.2 per cent from N30.323 trillion recorded at the end of December 2024, as total deposits grew by 7.7 per cent from N24.651 trillion at the end of last year to N26.54 trillion at the end of September 2025. Gone.

UBA shareholders' funds remained very strong at N4.301 trillion, an increase of 25.8 per cent from N3.418 trillion recorded in December 2024, again reflecting a strong potential for internal capital generation and growth.

Also read: UBA, Renewvia will power 25 bank branches with solar energy

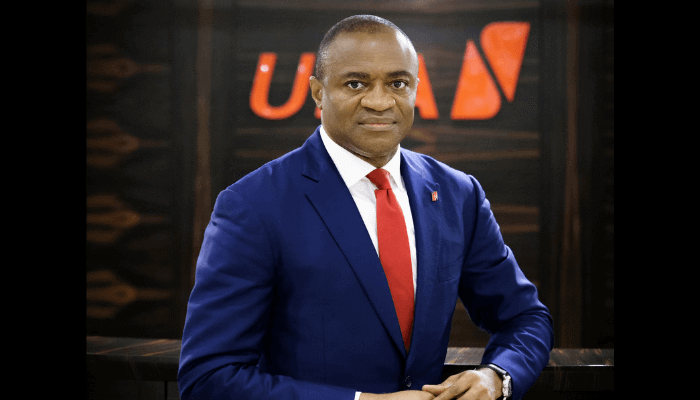

Commenting on the results, Group Managing Director/CEO of UBA, Oliver Alawuba, said the bank continues to demonstrate the strength, resilience and diversification of its business in a dynamic operating environment.

“We delivered solid performance supported by prudent balance sheet management, innovation and a well-diversified earnings base across all our markets,” he said.

According to him, with the increase in profit after tax from N525 billion to N538 billion, the Bank is reflecting its continued earnings momentum and commitment to sustainable growth with strength in Nigeria, African network and global presence amid persistent macroeconomic headwinds.

Updating shareholders and investors on its recent recapitalization efforts, GMD said: “I am pleased to report that we have made significant progress in raising our capital as part of the mandatory industry-wide recapitalization exercise with the successful completion of Phase II of the Rights Issue. This has strengthened our capital base and will support the continued, prudent expansion of our operations in our markets.”

Alawuba emphasized UBA's unwavering focus on disciplined execution and strategic growth to ensure delivery of sustainable returns and long-term value to all shareholders.

UBA Executive Director, Finance and Risk, Ugo Nwaghodoh, who also spoke on the results, explained that the group recorded steady growth in earnings, with gross income rising to N2.47 trillion, driven by a 10.1% increase in interest income and a 6.2% increase in net interest income.

He said total assets increased by 7 per cent to N32.5 trillion, supported by concentrated deposit mobilization and increased investment in acquiring assets.

“Shareholders' funds grew by 26% to N4.3 trillion, underscoring investors' continued confidence in the group's strategy, while capital adequacy and liquidity ratios remain well above regulatory limits and provide important buffers to support continued growth,” he said.

Speaking on the bank's efforts to strengthen its performance for the remaining financial year 2025 and beyond, Nwaghodoh said, “We remain focused on maintaining profitability, expanding our digital income streams and delivering long-term value to our shareholders.”

United Bank for Africa is one of the largest employers in the financial sector on the African continent, with a workforce of 25,000 and serving more than 45 million customers globally. Operating in twenty African countries and the United Kingdom, United States, France and the United Arab Emirates, UBA provides retail, commercial and institutional banking services, leading financial inclusion and applying cutting-edge technology.