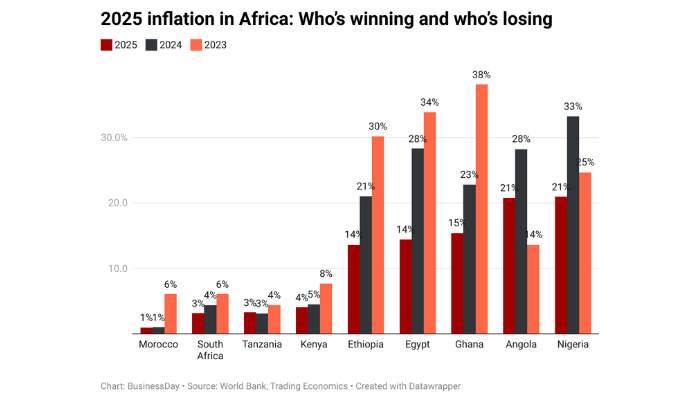

In many parts of Africa, headline inflation is set to ease in 2025 after peaking in 2023-2024. Tighter monetary policies, stabilizing food and energy prices, and relatively stable currencies have helped ease price pressures.

A BusinessDay analysis of Africa's 10 largest economies based on World Bank data shows Morocco recorded the lowest average inflation at 0.94 percent from January to October, followed by South Africa at 3.15 percent.

Among other top 10 economies, average inflation from January to November stood at 3.3 percent in Tanzania, 4.04 percent in Kenya and 13.6 percent in Ethiopia. Further down the list were Egypt (14.4 percent), Ghana (15.4 percent), Angola (20.8 percent), and Africa's most populous country Nigeria (20.96 percent).

Also read: What to do because inflation affects your savings?

Notably, Algeria recorded negative inflation of -0.40 percent in October, the first time in at least a decade.

On average, the nine countries, excluding Algeria, recorded an overall average inflation rate of 10.74 percent in 2025, 16.28 percent in 2024, and 15.57 percent in 2023. After a trough in 2023, regional economic activity is expected to grow by 3.8 percent in 2025, up from 3.5 percent in 2024, and will rise to average. 4.4 percent in 2026-27, according to the World Bank's latest Africa Pulse report.

“Consumer price inflation continues to decline in most sub-Saharan African countries, although at different paces,” the report said. “The projected acceleration in growth in 2025 is based on improved terms of trade in much of the region, contributing to currency stabilization and, in some cases, appreciation.”

The multilateral lender said the decline in inflation has allowed it to gradually ease monetary policy, boosting domestic purchasing power and creating space for further rate cuts. “These favorable conditions are promoting a recovery in private consumption and investment. However, ongoing fiscal consolidation may slow the pace of recovery in some economies,” it said.

low inflation countries

Morocco – 0.94 percent

Morocco recorded the continent's lowest inflation in 2025. That's after reaching a peak of 6.7 percent in 2022 and 6.08 percent in 2023 due to food and global price shocks. Inflation declined to about one percent in 2024 and remained low this year.

Lower food prices, a decline in imported inflation and a decline in core inflation have limited underlying price pressures. Bank al-Maghrib kept its policy rate at 2.25 percent, focusing on supporting growth rather than fighting inflation. The central bank plans to adopt an inflation-targeting framework from January 2027.

South Africa – 3.15 percent

South Africa's inflation remains within the Reserve Bank's three percent to six percent target range. The decline in the initial year was due to lower fuel prices, lower food inflation and weak domestic demand.

Last month, the country's central bank in its meeting had reduced the benchmark repo rate by 25 basis points to 6.75 per cent, the sixth cut in the easing cycle, reflecting an improved inflation outlook. Its 30 percent US tariffs and trade tensions have had limited impact on consumer prices.

Also read: Nigeria's inflation drops to 14.45% in November

Tanzania – 3.33 percent

Tanzania's inflation is set to rise from 3.1 percent in 2024 to 3.33 percent in 2025. The East African nation's long-term economic stability was tested by post-election unrest in October that disrupted investment and tourism.

In October, the Bank of Tanzania maintained its benchmark interest rate at 5.75 percent, expecting inflation to remain within the target range of three percent to five percent, supporting strong growth.

Kenya – 4.04 percent

Inflation in Kenya has been moderate, averaging 4.04 percent, due to the cost of food, transportation, and housing. The Central Bank of Kenya cut its benchmark lending rate to nine percent in December 2025, its ninth consecutive cut.

This easing reflects confidence in manageable inflation and is intended to stimulate lending and economic activity while maintaining exchange rate stability.

Countries with moderate to high inflation

Ethiopia – 13.6 percent

Ethiopia continues to experience high inflation, although this is expected to reduce from 30.2 percent to 13.6 percent in 2023 and 21 percent in 2024. Food inflation remains the primary driver, reflecting fluctuations in agricultural production, climate shocks, logistical constraints and insecurity.

Exchange rate pressures, foreign exchange shortages and monetary expansion have also contributed to imported inflation. A recent World Bank report ranked Ethiopia as one of Africa's weakest performing currencies, along with South Sudan, in the first eight months of 2025, citing declining export revenues, limited foreign exchange inflows and persistent macroeconomic pressures.

Ongoing economic reforms and improved crop conditions have helped ease price pressures, but structural constraints are limiting the pace of deflation.

Egypt – 14.4 percent

Egypt's urban inflation is projected to fall from 28.3 percent to 14.4 percent in 2024, following a 2023 currency devaluation and International Monetary Fund (IMF)-backed reforms. Tight monetary policy and the floating pound helped stabilize the economy.

Inflation fell to 12.8 percent in February, the lowest in nearly three years. The Central Bank of Egypt gradually reduced its overnight deposit rate from 27.25 percent to 21 percent between April and October while maintaining price controls.

Also read: At 14.45%, Nigeria's inflation falls below budget estimate for the first time in 6 years

Nigeria – 14.45 percent

Headline inflation slowed for the eighth consecutive month to 14.45 percent in November from 16.1 percent in October, according to data released by the National Bureau of Statistics (NBS) on Monday. The reading came slightly below the average estimate of economists surveyed by BusinessDay, underscoring the pace at which price pressures have eased since the start of the year.

The slowing inflation trend strengthens the case for a rate cut at the Central Bank of Nigeria (CBN) monetary policy meeting next February, providing much-needed relief to businesses hit by high interest rates. The Monetary Policy Committee (MPC) left the benchmark interest rate unchanged at 27 per cent at its last meeting, but has signaled plans to begin an easing cycle as inflation continues to decline.

Ghana – 15.4 percent

Ghana's inflation is projected to decline from 21 percent to 15.4 percent in 2024 and 30.2 percent in 2023, supported by the strong cedi, digital economy growth as well as cocoa and gold exports.

In November the Bank of Ghana cut its benchmark rate by 350 basis points to 21.5 percent, reflecting persistent deflation and strong external buffers. The currency's strength helped headline inflation enter a single-digit inflation rate of 9.4 percent in September, the first since August 2021.

high inflation countries

Angola – 20.8 percent

Inflation remains high in Angola, although below the peak of 28.2 percent seen in 2024. Food and energy prices remain under pressure due to currency instability and import dependence.

The National Bank of Angola gradually reduced the key interest rate to 18.5 percent in November, balancing the need for growth with price stability.

Also read: Nigeria's manufacturing grows 1.25% in third quarter amid easing inflation pressures

Notable case: Algeria – Deflation at -0.40 percent

Algeria is known for its negative inflation, with the CPI declining in some months, indicating rare deflationary pressures.

In June 2025, the CPI declined 0.22 percent year-on-year, the first negative reading in at least a decade, highlighting weak demand and low price pressures across key sectors.