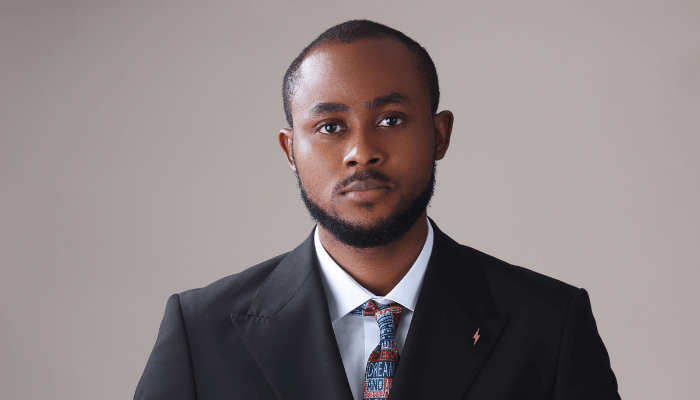

Moses Onyekchukwu wakes up every morning thinking about one problem – why African businesses still struggle to pay international suppliers quickly, securely and reliably.

As founder and CEO of Rosify, a fintech company building the infrastructure for cross-border trade payments, he has made it his life's work to remove the friction that has long held back African commerce.

Rojifi is not just another payments startup. It is a technology-driven, fully licensed Money Service Business (MSB) that combines the speed and innovation of FinTech with the rigor of traditional banking.

The platform leverages AI-powered fraud detection, transaction monitoring, and automated onboarding to ensure that operations are secure, fast, and transparent.

Also read: Why Nigerian businesses fail en masse and how the system and community fix it

“We are combining the speed of fintech with the discipline of traditional banking, which is a balance that serious businesses need,” Onyechukwu said.

“The platform is built to meet regulatory requirements across all jurisdictions, including transparency in every transaction,” he said.

Onyekchukwu already has a track record of solving real-world business problems. Prior to Rosifi, he ran several businesses involving procurement, importing and supplier relationships across Asia.

Through this work, they faced recurring challenges, including delays in access to foreign exchange, unreliable intermediaries, declined payments, expired documents and goods being held by suppliers due to payment complications.

“In Africa, you may have money but not the ability to move it quickly,” he said. “The longer you wait, the more you lose because FX is volatile, prices change, and suppliers lose confidence.”

These constraints, which are common to countless African businesses, gave rise to a simple but powerful idea, which is that African companies should be able to pay global suppliers seamlessly and reliably, without offshore entities, informal brokers or middlemen, and this idea became 'Rosify'.

Founded in 2019, Rojifi today provides cross border payment solutions for African businesses in sectors ranging from SMEs to large corporations including pharmaceuticals, airlines, oil and gas, manufacturing and bureau de change operators.

Through a combination of proprietary infrastructure and strategic partnerships, Rojifi enables companies to settle international invoices in over 200 countries, supporting major currencies such as USD, EUR, GBP and CNY.

Licensed as an MSB in Canada, the company is pursuing an International Money Transfer Operator (IMTO) license in Asia, establishing it as a truly global cross-border payments player, focused strictly on B2B trade flows.

For Onyekchukwu, the company's mission is not just to move money, but to build the infrastructure that enables African economic participation.

“When African businesses can pay suppliers promptly, transparently and in their own name, trade becomes easier, trust increases and growth is accelerated,” he said.

By breaking down decades-old barriers, he is helping African businesses operate on a level playing field in global commerce with reliability, speed and confidence.

What sets Onyekachukwu apart is how deeply his approach is shaped by his own entrepreneurial journey.

Experiencing these trade frictions first-hand gave him insight that many investors, regulators and international partners often lack, which is the daily reality of African businesses trying to operate on a global scale.

“I knew solving this problem required more than software. It required building trust, understanding the regulatory environment, and building a platform designed from the ground up for Africa's unique challenges,” he said.

Also read: How to quickly identify a dispute: Red flags businesses often miss

Under his leadership, Rojifi has grown from a small startup to a trusted partner for African businesses. The company now handles millions of transactions every month, providing secure, cost-effective and efficient payments that give African companies the reliability and operational reliability they need to expand.

Onyekchukwu leads a team of professionals who share his vision, leveraging technology and deep financial expertise to unlock cross-border opportunities for businesses across the continent.

Onyekchukwu also sees Rogify as a means to broader economic impact. By enabling financial inclusion and access, the company contributes to job creation, business growth and stronger connections between African companies and the global market.

“I am always looking for new opportunities and challenges to expand my reach and impact and innovate our products and processes,” he said. “I believe that by empowering businesses to transact seamlessly, we can drive positive social and economic change for Africa and the world.”

Despite the complexity of cross border finance, Onyechukwu is focused on simplicity for its customers.

Rojifi's onboarding process is designed to get businesses up and running faster, while its payment system provides flexibility, security, and transparency every step of the way.

It is the combination of technology, compliance and deep market understanding that has allowed the company to carve out a niche as a trusted partner in a market that has historically struggled with reliability and trust.

Looking ahead, Onyekchukwu has ambitious plans for Rozifi, as he envisions a future where African businesses can expand globally without worrying about currency volatility, intermediary delays or opaque banking processes.

He said, “Our goal is to remove every friction point that holds African business back. We want African companies to operate with the same efficiency, reliability and confidence as businesses anywhere in the world.”

For Moses Onyekchukwu, Rosifi is not just a fintech company; This is the infrastructure for Africa's future. By transforming the way African businesses pay, they are not only solving a transaction problem, they are also creating a platform for trust, growth and global integration.

“Africa is ready for the world. We are making it easier for the world to meet Africa on equal terms,” he said.