With the Nigerian Exchange (NGX) already up 4.9 per cent in 2026 and market capitalization above the N100 trillion mark, some investment calls are starting to move faster than expected. Many stocks with bullish signals have already attracted strong buying interest, reflecting continued optimism across the market.

In 2025, NGX returned 51.2 percent, driven by some stellar performers. NCR Nigeria leads the pack with a gain of 1,354 per cent, followed by Unicel, which has gained 497 per cent during the year. Consumer goods stocks dominate the leaderboard and early signs suggest risk appetite will remain intact in 2026. In this story, BusinessDay reviews the financial metrics behind stocks with compelling upside potential in the new year. One name that stands out is May & Baker.

Also read: May & Baker: Paracetamol giant to watch in 2026

May and Baker's 2025 performance in context

Among healthcare stocks listed on NGX, May & Baker (M&B) was not the sector's top performer in 2025. Still, the return of 102 percent during the year was far from normal. The stock's performance only appears sluggish when viewed alongside the larger rallies recorded by some pharmaceutical competitors.

Neemith Pharmaceuticals returned 153 per cent in 2025, while Fidson Healthcare gained a whopping 223 per cent, making both among the best-performing healthcare stocks on the exchange. Yet beneath the surface, May and Baker's fundamental principles tell a more compelling story. Based on its nine-month 2025 financial results, BusinessDay is tracking meaningful upside potential for the stock, momentum that is starting to translate into price action in early 2026.

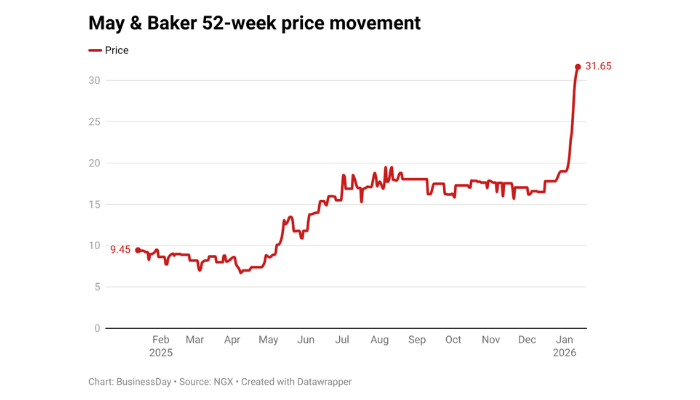

In the first eight trading days of the year, May & Baker's share price jumped 67 per cent, rising from N19 on January 12 to close at N31.65. The rally reflects renewed interest from investors, based on improving earnings quality, strong margins and attractive valuation metrics.

For the nine months ending 2025, May & Baker recorded a net profit of N3.3 billion, representing a 77 per cent increase year-on-year. Compared to competitors like Fidson, Mecure and Nemeth, the company posted the highest net profit margin at 11.3 percent, highlighting superior cost discipline and pricing strength. Notably, the nine-month profit is already higher than the company's full-year net income for 2024, pointing to a materially stronger earnings result for FY2025.

Also read: Kim Jerry Bot wins 2025 May and Baker Professional Service Awards in Pharmacy

Core pharmaceuticals enhance revenue quality

Segment data reinforces the quality of earnings. Pharmaceuticals accounted for over 98 per cent of the group's revenues and profits, while the beverages segment remained marginal.

This concentration highlights May & Baker's strengths in core pharmaceutical operations, particularly in branded generics and contract manufacturing, where margins are more flexible.

May & Baker's Paracetamol, instantly recognizable by its distinctive red packaging, has come to dominate the Nigerian analgesic market, especially with the exit of GSK's Panadol. For investors, buying into M&B is effectively a bet on the enduring strength of its brands and their ability to maintain market leadership across different cycles.

The balance sheet also tells a story of increasing flexibility. Total assets increased to N25.8 billion by September 2025, up from N22.5 billion at the end of 2024. Cash and cash equivalents grew sharply to N5.4 billion compared to N3.2 billion in full year 2024, providing strong liquidity and operational flexibility. Retained earnings increased to N8.26 billion, reflecting profit accumulation even after dividend payments.

While borrowings increased, the increase was largely offset by higher earnings and stronger operating cash flows. Net cash generated from operating activities during the period stood at N1.87 billion, underscoring the company's ability to convert accounting profits into cash. This matters in a high-interest rate environment, where leverage without cash creation can quickly destroy equity value.

Also read: May & Baker profits rise 77% to N3.34 billion as revenues exceed costs

Despite these improvements, valuations remain less demanding. At a price-to-earnings ratio of approximately 14.6x, May & Baker trades at a discount to most healthcare peers on the NGX. Its price-to-book ratio of 3.88 times also appears conservative when set against an average return on assets of 13.9 per cent, the highest in the sector over the nine months.

Dividend yield remains a major hurdle for income-focused investors. To 2025, the stock offered a yield of about 3 percent, which is modest by broader market standards. Yet, at current earnings levels, a potential dividend of N1 per share represents a 150 per cent increase compared to the 40 kobo paid for 2024. This points to increasing potential for strong shareholder returns over time.

In a market that's driven by earnings sustainability rather than major rallies, May and Baker's improving fundamentals stand out. The company's recent price action looks less like a short-term uptrend. Instead, it looks like a valuation re-rating is already underway.