The Nigerian Exchange Regulation Limited (NGXRegco) has granted UPDC Plc a significant extension to overcome its free float shortfall.

The two-year grace period provides additional time to the real estate firm to bring its public shareholding spread in line with the listing standards of the exchange.

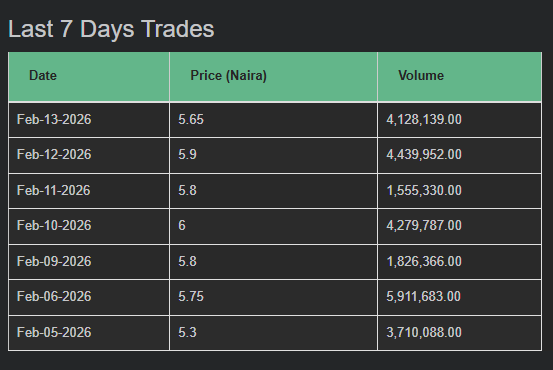

UPDC has 18,559,969,936 shares outstanding, but the X-Compliance Report, a transparency initiative of NGX Regulation Limited (NGX Regco), shows that the company has only 4.89 per cent free float, valued at N5.214 billion. The compliance due date for the company ended on February 6, 2026.

“The Board of Directors of UPDC Plc informs its respected shareholders that NGX Regulation Limited (NGX Regco) has approved the Company’s request for extension of time to achieve the required free float limit within two years (2026-2028).

“This is to enable the company to comply with the free float requirements of the Nigerian Exchange Limited of 20 per cent of issued and fully paid-up share capital or N20 billion free-float market capitalization for companies listed on its main board and to ensure that the company comes back into compliance with its post-listing obligations,” UPDC said in a recent statement at NGX.

ALSO READ: Naira touches N1,390 in black market, spread narrows by 2.5%

Companies listed on the NGX are required to maintain a minimum free float to the prescribed standards under which they are listed to ensure that there is an orderly and liquid market for their securities.

The free float requirements for companies listed on the various boards of the NGX show: For the Growth Board, a minimum of 10 per cent of the issued and fully paid shares for the entry segment or the value of its free float is equal to or above N50 million.

For Growth Board, a minimum of 15 per cent of the issued and fully paid shares or the value of its free float is

Equal to or above N50 million for the standard segment.

For the Main Board, a minimum of 20 per cent of the issued and fully paid up shares or the value of its free float is equal to or more than N20 billion.

For the premium board, a minimum of 20 per cent of the issued and fully paid shares or the value of its free float is equal to or more than N40 billion.

The recent approval granted to UPDC circumvents immediate regulatory restrictions and allows the board to execute strategic maneuvers to meet the 20 per cent free float limit – such as a sale by major shareholders or fresh share issuance.