As global lenders step back, Nigerian and South African banks are expanding across the continent, reshaping African finance as the shift toward regional capital continues. While Nigeria's business activity signals a strong growth outlook, structural risks remain, underlined by the oil-dependent rebound in countries such as South Sudan and the uneven return of global investment attention to Africa.

Nigeria's big banks deepen African expansion as global lenders retreat

from nigeria The biggest banks are growing rapidly Their expansion across Africa, deploying new capital from the country's recapitalization drive to diversify earnings and fill the void left by retreating global lenders.

why it matters: The shift positions Nigerian banks as the continent's next major regional lenders, reshaping Africa's banking landscape and redirecting capital flows within the continent.

Nedbank steps up bet on East Africa with $856m NCBA acquisition

South African Nedbank has agreed To acquire a 66 per cent stake in Kenya's NCBA Group in an $856 million deal, giving the lender a stronger foothold in East Africa's fast-growing banking markets.

why it matters: The deal signals new confidence in East Africa's financial sector and highlights growing intra-African consolidation as regional banks grow.

World Economic Forum to revive Africa summit in 2027

World Economic Forum will resume hosting Its Africa summit in South Africa in April 2027 ends a seven-year hiatus caused by the COVID-19 pandemic.

why it matters: The return of the summit could help restore Africa's visibility in global investment and policy arenas at a time of capital tightening and increasing geopolitical competition.

Business activity data points to Nigeria's fastest growth in three years

nigeria perseveres private sector expansion Throughout 2025, prospects for its strongest economic growth since 2022 have increased as inflation eases and foreign exchange conditions stabilise.

why it matters: Continued trade expansion boosts investor confidence and strengthens the case for a sustainable economic recovery after years of macroeconomic instability.

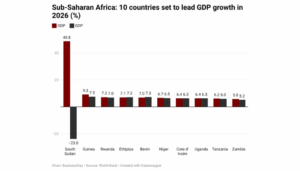

South Sudan's GDP is estimated to be the highest in Africa in terms of oil recovery.

is south sudan Africa is estimated to post According to the World Bank and IMF, the resumption of oil exports will lead to the highest growth rate in 2026.

why it matters: The rebound underlines how oil remains the country's economic lifeline, while highlighting the risks of growth driven by a single, fragile revenue source.

chart of the week