…the second largest decline was recorded in developing regions

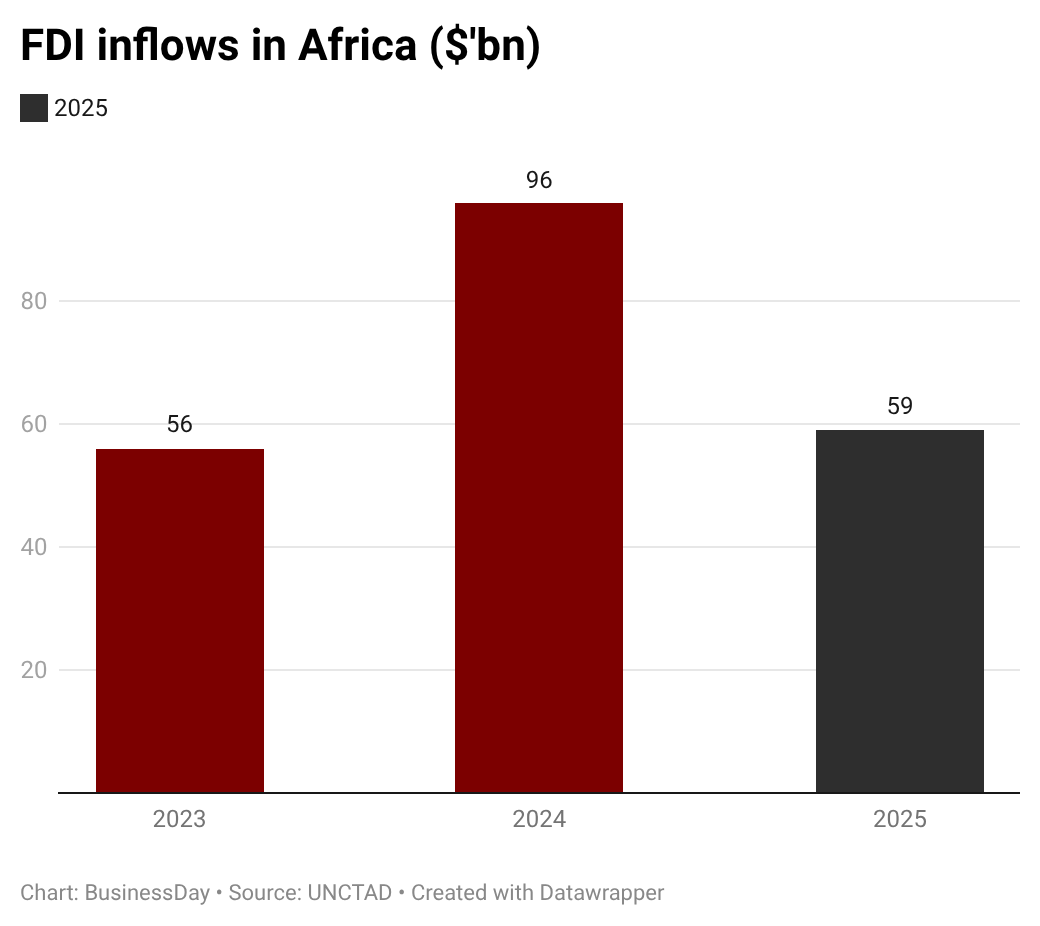

According to preliminary estimates by the United Nations Conference on Trade and Development (UNCTAD), Africa will struggle to attract foreign direct investment (FDI) in 2025 as inflows declined by 38 percent, while global FDI increased by 14 percent.

The report released on Tuesday showed that FDI into the continent is expected to decline from $96 billion to $56 billion in 2024, a reversal of the gain recorded a year ago. However, the 2025 figure was broadly in line with 2023 levels, underscoring the unsustainability of investment flows into Africa.

UNCTAD attributed this sharp decline largely to major disinvestment, particularly in South Africa. Investment activity weakened in key sectors including green hydrogen, mining and infrastructure, although some countries showed resilience. Strong inflows were recorded in Angola and Mozambique, while Nigeria saw little change at the end of the year.

“FDI inflows declined sharply by about a third, reflecting a return to prior levels following a surge in FDI numbers in 2024 driven by a large project,” the report said. Among African economies, investment in Angola reached an estimated $3 billion, marking a return to positive territory after nine consecutive years of net disinvestment.

Egypt remained Africa's largest FDI destination, attracting an estimated $11 billion in inflows. Supported by the resumption and acceleration of construction on major liquefied natural gas projects, Mozambique recorded an 80 percent increase in FDI to nearly $6 billion.

The continent recorded the second largest decline in FDI into developing regions. The United Nations organization noted that the most significant factor among middle-income African economies was a major disinvestment in South Africa, which recorded a $6 billion negative inflow following the $7.2 billion spin-off of its 66.7 percent stake in Anglo American PLC's Valterra Platinum Ltd.

Globally, FDI inflows into developed economies are expected to increase by 43 per cent to $728 billion in 2025, driven mainly by Europe and major financial centres. The EU recorded growth of 56 percent, supported by large cross-border acquisitions and a boom in major economies including Germany, France and Italy.

But FDI inflows into developing economies declined by 2 percent to $877 billion. Low-income countries were hardest hit, with almost three-quarters of least developed countries recording stable or declining growth.

The report also highlights the increasing concentration of global investment in capital-intensive and technology-driven projects. Data centers alone accounted for more than a fifth of global greenfield project values in 2025, with announced investments of more than $270 billion, driven primarily by demand for artificial intelligence infrastructure and digital networks.

France, the United States and the Republic of Korea led the way as host countries for these projects, while emerging markets such as Brazil, India, Thailand and Malaysia also attracted significant investments.

Looking ahead, UNCTAD said the risk of a decline in global investment is increasing. While there may be a modest increase in FDI inflows in 2026 if financing conditions ease and cross-border mergers and acquisitions improve, actual investment activity is likely to remain low.

“Geopolitical tensions, policy uncertainty and economic fragmentation are weighing on investor confidence,” the organization warned. He warned that without coordinated action, global investment risks are becoming increasingly concentrated in a few sectors and regions.