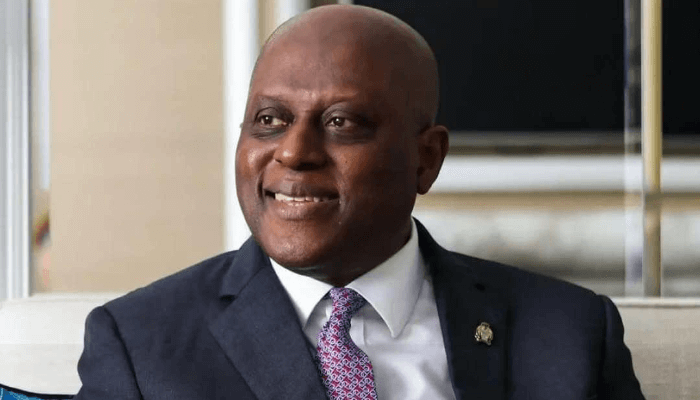

Governor Olayemi Cardoso has called on African central banks and development finance institutions to take a more coordinated approach to enhancing growth, industrialization and climate resilience across the continent, warning that Africa's financial future depends on aligning stability with sustainability.

Speaking at the Egypt 30by30 event organized by the Central Bank of Egypt and the International Finance Corporation, Cardoso said Africa must accelerate growth, create jobs, expand economic opportunities and lift millions out of poverty, while simultaneously reducing carbon emissions and strengthening its resilience to climate shocks.

He described the collaborative ambition behind the 30by30 initiative as emblematic of a shared continental vision that prioritizes resilience, climate awareness and long-term economic sustainability.

Cardoso said that through close cooperation with the Central Bank of Egypt and World Bank Group partners, the CBN is committed to building a resilient and risk-aware financial architecture, advancing green finance, strengthening cross-border cooperation, and helping African economies not only withstand shocks, but also thrive amid global uncertainty.

“Resilience starts with credibility,” Cardoso said, noting that disciplined and transparent reforms in Nigeria are strengthening macroeconomic fundamentals and restoring confidence in the financial system.

“To build a resilient financial system, we must base our economies on trustworthy institutions, reliable policies, transparent markets, and risk-aware innovation,” he said.

He stressed that climate considerations can no longer sit on the margins of fiscal policy. “Climate risk is financial risk. It affects sovereign ratings, cost of capital, inflation dynamics, food security, insurance markets and fiscal stability,” he said.

Cardoso argued that while Africa contributes the least to global emissions, it bears some of the heaviest climate-related costs. At the same time, he pointed to the continent's vast renewable energy potential, biodiversity wealth, young population and fast-growing financial markets as structural advantages that can underpin sustainable growth.

“To take advantage of these opportunities, we must innovate for resilience, not as isolated countries, but as a continent,” he said. “By working together intentionally, transparently, and with unwavering commitment, we can build the resilient, sustainable and inclusive financial system that Africa needs not only to withstand future shocks but also to thrive in the decades to come.”

The partnership underlined what Cardoso described as a defining imperative for the continent: Africa's development trajectory will depend on a dual commitment to macroeconomic stability and climate-smart financial development.