The federal government says the country will enter a new phase of economic expansion in 2026, moving from macroeconomic stabilization to accelerated growth, investment mobilization and job creation, as it aims for a $1 trillion economy by 2036.

The new direction, led by the Federal Ministry of Finance (FMF), builds on reforms implemented over the past two years, including exchange rate unification, energy market restructuring and fiscal consolidation, and what officials now describe as a “second wave” of growth-focused reforms.

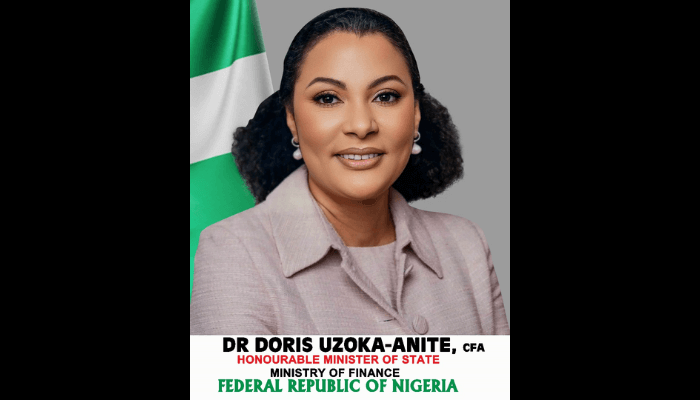

According to Doris Uzoka-Anyate, Minister of State for Finance in a statement, the administration's priorities in 2026 are to expand production, deepen domestic value creation and unlock private capital on a large scale.

“Our focus is to move decisively from stabilization to development,” Uzoka-Anite said. “The ongoing reforms are designed to reduce risk, unlock private capital and ensure that Nigeria delivers sustainable returns for investors while expanding opportunity for our citizens.”

He said Nigeria's economy is transitioning into an expansionary phase, with government policy now focused on productivity, capital formation and export competitiveness rather than short-term macroeconomic firefighting.

At the heart of the strategy is a development acceleration and investment mobilization framework, coordinated by the FMF in close alignment with the Central Bank of Nigeria (CBN).

Also read: Nigeria aims for greater capital inflows with new central investor desk

The government says this coordination is important to reduce inflation expectations, reduce the sovereign risk premium and reduce the cost of capital in the economy.

The fiscal and monetary authorities have jointly adopted the Disinflation and Growth Acceleration Strategy (DGAS), which the Finance Ministry says will guide policy implementation and restore investor confidence in the medium term.

“Macroeconomic forecasting is essential for investment,” Uzoka-Enite said. “We remain focused on consistent policies, disciplined execution and clear regional pathways that investors can trust.”

The government's growth plan is clearly sector-led, with priority given to energy and gas-based industrialization, agribusiness, manufacturing, housing, health care, digital services, creative industries, logistics and solid minerals. Officials say price controls and regulatory barriers that have historically hindered these sectors will be eliminated to allow market-driven expansion.

In line with the “Nigeria First” policy initiated by President Bola Ahmed Tinubu, Nigeria is also positioning domestic value chains as a central pillar of its development ambition. This approach prioritizes the use of locally sourced raw materials, labor and intellectual property while maintaining an open, export-oriented economic model.

Uzoka-Anite said the goal is to rebuild Nigeria's competitiveness in non-oil exports, citing cocoa processing and agricultural value chains as examples of sectors with immediate potential to boost foreign exchange earnings while meeting international market standards.

A key component of the 2026 Agenda is capital formation. The government plans to deepen Nigeria's capital and insurance markets by expanding long-term local currency instruments, improving market transparency and strengthening investor protection. Pension funds, insurance companies and other institutional investors are expected to play a larger role in financing infrastructure, housing and productive sectors.

In parallel, insurance sector reforms will focus on recapitalization and improved supervision to strengthen risk management and project bankability, particularly in climate-sensitive and capital-intensive sectors.

“Capital formation is at the heart of our growth acceleration strategy. We are focused on expanding long-term, patient capital, reducing investment risk and ensuring efficient allocation to productive sectors,” he said.

The administration is also placing a renewed emphasis on financial inclusion and consumer credit as drivers of domestic demand. Working with banks, fintechs and microfinance institutions, the government plans to expand access to affordable credit for households, micro-enterprises and informal sector participants, with a special focus on women and youth-led businesses.

Development finance institutions (DFIs) are expected to play a more strategic role in delivering the agenda, as the Ministry of Finance takes over quasi-fiscal development finance responsibilities previously placed in the CBN. Domestic DFIs such as Bank of Industry and Nexim Bank will be established as key execution vehicles for priority sectors, supported by better capitalization, stronger governance and enhanced risk-sharing instruments.

Given Nigeria's estimated long-term capital needs of approximately N246 trillion by 2036, the government considers DFIs essential to attract private and foreign capital through blended finance, guarantee and co-investment structures.

On the fiscal side, the government says it will step up non-oil revenue mobilization in 2026, following the implementation of new federal tax laws effective from January 1. A new revenue optimization platform (RevOps) is being rolled out across federal agencies to improve compliance, transparency, and real-time visibility into government revenues.

Uzoka-Anite said the digitization of revenue collection, including mandatory electronic receipts for all federal services, will strengthen accountability and improve cash management across government.

The administration also plans to optimize household debt by creating fiscal space for infrastructure and human capital investments, extending maturity periods, and reducing short-term interest burdens, alleviating pressure on financial markets.

To improve execution efficiency, the government is accelerating the digitalization of public sector workflows and investment approvals with the aim of reducing transaction costs and improving Nigeria's competitiveness as an investment destination.