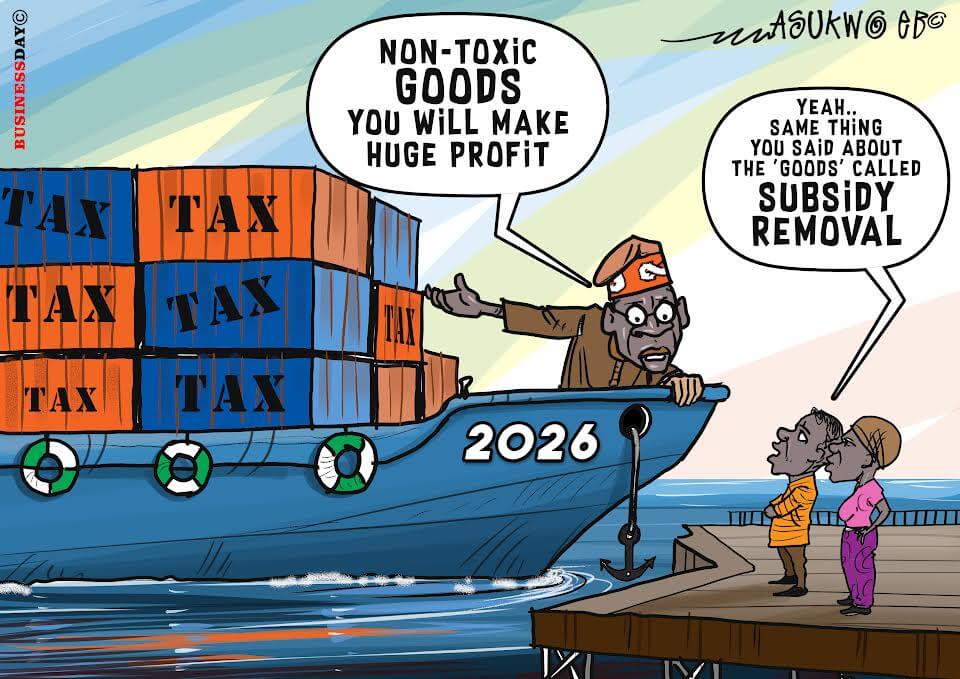

Banks will deduct 10% withholding tax on foreign currency interest from today

Nigerian banks will commence deducting 10 per cent withholding tax on interest earned on foreign currency deposits from January 1, 2026, in line with the Nigeria Tax Act, 2025. Access Bank informed customers on Wednesday that the cut applies to all FCY deposit interest, with taxes remitted to the federal government in line with regulatory requirements.

The directive is part of a broader change in banking transactions effective from the new year. The electronic money transfer levy of N50, which was previously charged to recipients on transfers of N10,000 or more, will now be deducted from the accounts of senders. The Nigeria Revenue Service in October directed banks to deduct withholding tax from interest payments on short-term investment securities, ending a decade-long grace period set to expire in January 2022. The tax applies to treasury bills, corporate bonds, promissory notes, government bonds, commercial paper and bills of exchange, with the exception of Nigeria Federal Government bonds and Central Bank OMO bills.

NNPC makes N502bn profit

Nigerian National Petroleum Company Limited recorded a profit after tax of N502 billion in November 2025, maintaining profitability despite producing an average of 1.36 million barrels of crude oil per day during the month. Revenue stood at N4.36 trillion due to improved gas production, availability of stable infrastructure and domestic fuel supply.

The state oil company simultaneously cut pump prices below N800 per litre, thereby joining the downstream price war triggered by Dangote Refinery's reduction of N739 per liter at MRS stations. NNPC filling stations along the Lagos-Ibadan Expressway on Wednesday sold petrol at N785 per litre, down from about N875 per liter two weeks ago. The adjustment came a few weeks after Dangote reduced ex-depot prices from N828 to N699 per liter as customers shifted to cheaper outlets. Gas production remained relatively stable at 6,968 million standard cubic feet per day in November, supporting the company's revenue performance. Statutory payments into the federation account between January and October 2025 reached N12.12 trillion. Chief Executive Bayo Ojulari assured Nigerians that market competition would benefit consumers, describing the current tensions as natural consequences of Nigeria's transition from import dependence to domestic refining.

Also read: Four mega trends shaping the Nigerian economy in 2026

Elumelu becomes Seplet's largest shareholder in $496 million transaction

Tony Elumelu has become the largest shareholder in Seplet Energy through the $496 million acquisition of a 20.07 percent stake from Morrell & Promes. The deal, completed through Heirs Holdings and its subsidiary Heirs Energies, involves 120.4 million shares sold at 305 pence per share.

M&P received an initial payment of $248 million, with the balance due within 30 days, secured by an irrevocable letter of credit. Additional contingent consideration of up to $10 million may be payable depending on Seplat's share price performance over the next six months. M&P, one of Seplet's three founders and its largest shareholder since 2010, described the investment as delivering strong returns from the start. Chief executive Oliver de Langavant said the company believes now is the right time to monetize the position and focus on direct investments in oil and gas assets. Seplet shares rose 11 percent in London after the announcement, while M&P shares rose 8 percent in Paris. Heirs Holdings executed a $750 million financing arrangement with the African Export-Import Bank ahead of the transaction.

Anthony Joshua has left the hospital

British boxer Anthony Joshua was released from Lagos Hospital on Wednesday afternoon after being found medically fit by Nigerian authorities to recuperate at home. The two-time former heavyweight champion and Olympic gold medalist was placed under observation following a fatal car crash near Lagos on Monday that killed two of his close associates and team members.

Lagos State Commissioner for Information, Gbenga Omotoso, confirmed that Joshua and his mother went to a funeral home in Lagos on Wednesday afternoon to pay their last respects to Sina Ghaemi and Lateef Ayodele as they were being prepared for repatriation. Ghami served as Joshua's strength and conditioning coach, while Ayodele was a trainer, and both men were longtime friends of the boxer. The accident occurred on the crowded Lagos-Ibadan Expressway when the vehicle carrying Joshua collided with a parked truck. The hired driver has been released from the hospital and is cooperating with police, with authorities indicating he may face charges of reckless driving. Police are searching for the truck driver who fled from the spot immediately after the accident. The incident occurred less than two weeks after Joshua's knockout victory over Jake Paul in Miami.

Stock exchange adds N36.46tn to market capitalization for 2025

The Nigerian exchange recorded N36.46 trillion in market capitalization gains during 2025, closing at N99.2 trillion compared to N62.92 trillion in early January. The all-share index rose to its year-end level of 103,180.14 points, reflecting investors' continued confidence throughout the period.

Market capitalization grew steadily during the year, reaching N67.19 trillion by the end of February before trending upward. In the last trading session of 2025, investors exchanged 1.23 billion shares worth N35.13bn in 27,872 deals. The market situation remained positive, prices of 47 shares registered an increase while 16 shares recorded a decline. Aluminum Extrusion Industries gained 9.9 per cent to close at N21.65 per share. CHAMS recorded the highest trading volume with 710.28 million shares exchanged, followed by Zenith Bank with 58.76 million shares traded. Aradel Holdings led the value transactions with N9.52 billion, followed by Seplet Energy with N7.12 billion and Zenith Bank with N3.67 billion.