Nigeria's investment landscape is undergoing a dramatic shift, as new data from the Securities and Exchange Commission (SEC) shows that cryptocurrencies and gambling have eclipsed traditional stock market participation, underscoring the growing distrust in traditional investment channels.

According to SEC Director General Imomotimi Agama, between July 2023 and June 2024, Nigeria's cryptocurrency market recorded transactions worth $50 billion.

He said this boom is in stark contrast to the stagnation in the country's formal capital market, where less than 4 percent of Nigerian adults are active investors.

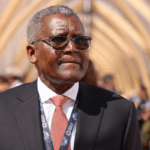

Speaking at the annual conference of the Chartered Institute of Stockbrokers (CIS), Agama described the imbalance as worrying, warning that the country's capital formation goals were being undermined by the exodus of potential investors towards speculative and higher-risk options.

Also read: Financial literacy important to avoid investment risks – Awirigwe

“While less than three million Nigerians participate in the capital markets, more than 60 million engage in gambling activities daily,” Agama said. He said Nigerians spend an estimated $5.5 million every day on betting platforms.

“This pattern reflects a deep cultural and economic shift away from long-term value creation toward immediate gratification,” he said.

The SEC chief said the rise of crypto trading highlights both the sophistication and risk appetite of the younger generation of investors, which are largely detached from traditional capital markets.

For many Nigerians, digital assets and online gaming offer instant access, fewer bureaucratic hurdles and the perception of higher returns compared to the slow-moving equity market, he said.

Despite listing some of Africa's largest corporations, Nigeria's stock market remains shallow relative to the size of the economy. The country's market capitalization-to-GDP ratio is around 30 percent, much lower than emerging market competitors such as South Africa and Malaysia.

This trend underlines the crisis of confidence in Nigeria's financial institutions and the growing preference for decentralized or alternative income streams.

Also read: Public debate on global regulations and online gambling boom

The SEC is pushing reforms under its Capital Markets Master Plan 2015-2025, which aims to broaden retail participation, improve investor education, and deepen market liquidity.

Still, Agama cautioned that without renewed trust and access, Nigeria risks losing a generation of potential investors to unregulated platforms.

“Our challenge is not just to deregulate, but to reinvent. We must create a capital market that inspires confidence, competes with innovation and rewards patience over speculation,” he said.

As cryptocurrencies and gambling continue to attract millions of Nigerians, the SEC's warning underscores a broader economic reality: The formal market is struggling to keep pace with a digital and risk-taking population that prioritizes the thrill of the next bet rather than the promise of long-term investments.