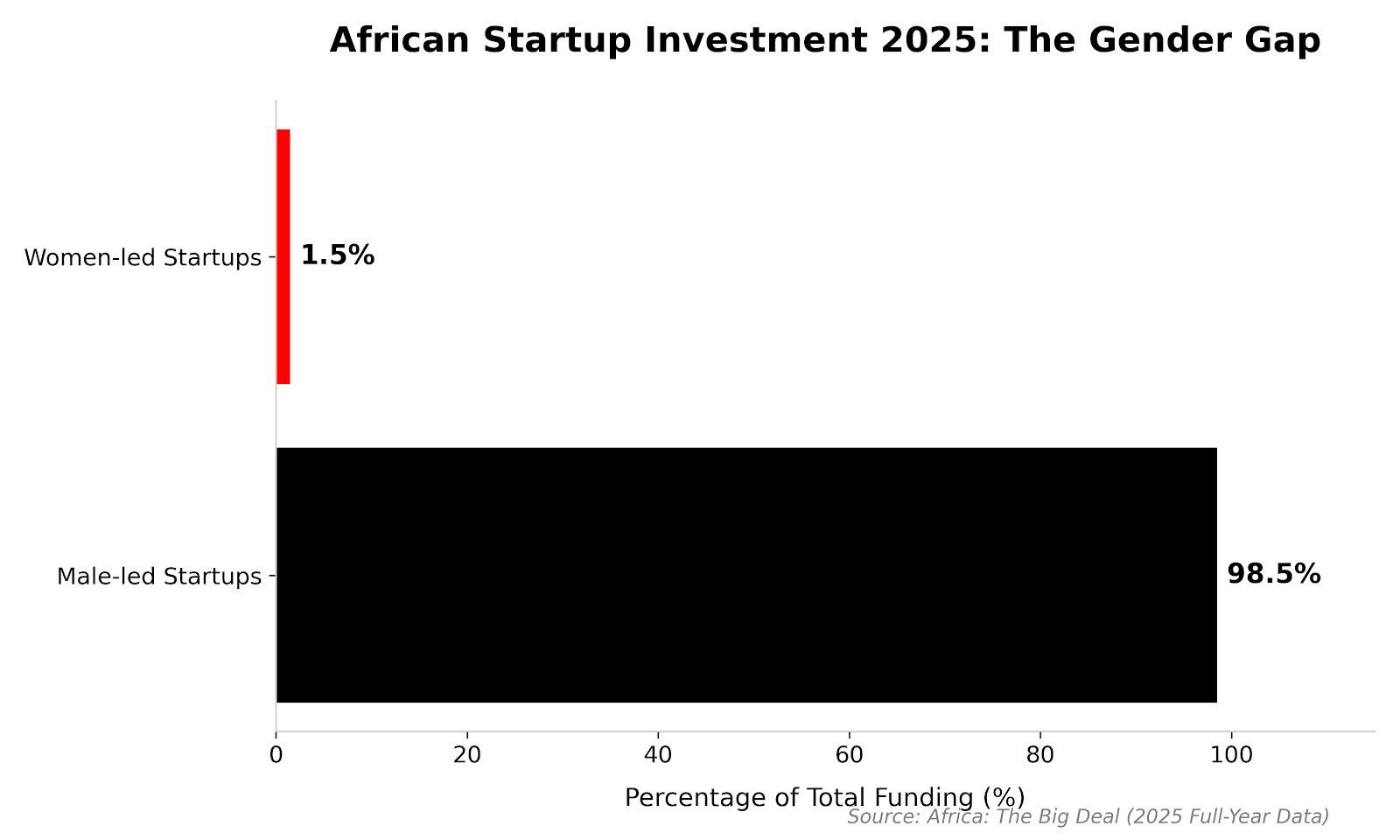

Women-led startups continue to receive a disproportionately small share of venture capital in Africa, even as the continent's broader startup investment landscape is showing signs of improvement after two difficult years.

According to research firm Britter's 'Africa Investment Report 2025', less than 10 percent of all venture funds deployed across Africa in 2025 went to companies with at least one female founder. Despite a modest bounce in overall investment activity, the figure underlines the persistence of gender-based disparities in capital allocation.

African startups raised nearly $3.8 billion in funding disclosed in over 630 deals in 2025, with deal volume increasing year-on-year. However, capital remained heavily concentrated among a small group of late-stage companies and a narrow set of sectors, limiting the spillover benefits of the rebound for women-led enterprises.

“Less than two percent of capital in Africa today is going into women's businesses. If you start investing when no one is looking, you can make some great investments,” Adesuwa Okunbo Rhodes, founder of Aruwa Capital Management, told BusinessDay.

Britter's report shows that female founders were particularly excluded from larger funding rounds. Mega-deals of $50 million and above accounted for nearly a quarter of all disclosed funding value in 2025, yet these transactions were largely captured by male-led or male-dominated founding teams, reinforcing the gender gap at the scale-up stage.

“The gender funding gap is not a short-term anomaly; it is structural,” the report said, citing barriers such as limited access to investor networks, lower investor risk tolerance towards women-led ventures and the concentration of capital in capital-intensive sectors such as fintech infrastructure, energy and mobility.

While women-led startups were more visible in the early stages, especially in education, health, agriculture and social-impact-driven businesses, their ability to scale was significantly limited. The average deal size for early-stage companies remained relatively low in 2025, and securing follow-on funding proved difficult as investors prioritized capital efficiency and established revenue models.

The supplementary findings of the MoneyPoint report titled ‘Financing Nigeria’s Women-Owned Businesses – A Case Study on MoneyPoint’s Working Capital Loans’ highlight the financing pressures faced by women entrepreneurs.

The report found that 40.2 percent of women rely on personal money and savings to start or maintain their businesses, while 59.8 percent seek external financing, often in the form of loans or cash gifts from family and friends.

Despite these efforts, the report estimates a financing gap of 32 percent, with women entrepreneurs less likely to secure funding or receive smaller ticket sizes than their male counterparts. This gap becomes more pronounced as businesses grow, reinforcing the under-representation of women in later-stage funding rounds.

Industry stakeholders argue that policy and institutional reforms are important to reduce these losses. Fifehan Osikanlu, founder of Eden Venture Group, said supportive government policies are necessary to improve access to capital for women-led businesses in Nigeria.

Osasu Igbinedion-Ogwuche, Founder of TOS Group, highlighted the role of banks in facilitating access to credit. “Collateral is one of the biggest barriers preventing women from accessing loans. Banks should put in place interventions that allow women running small and medium-scale enterprises to access funding without stringent collateral requirements,” she said.

He said repayment data already supports the case for reform. “About 95 percent of Nigerian women have already proven their creditworthiness to repay their loans on time. Now is the time for policy makers and financial institutions to recognize this and implement solutions that enable women to grow and scale their businesses.”

Britter's analysis also points to geographic and regional concentration as complicating factors. The so-called 'Big Four' ecosystems: Nigeria, Kenya, South Africa and Egypt, continue to dominate funding flows in 2025, leaving female founders in leading and breakout markets facing even greater barriers to capital access.

Despite the bleak equity funding picture, the rise of alternative financing instruments, including grants, loans and blended finance, offers a potential route to widening access for women entrepreneurs. However, analysts caution that without deliberate intervention from investors, limited partners and policymakers, equity capital is unlikely to be systematically rebalanced.

Sarah Ngamau, managing director and partner at Moremi Fund, told BusinessDay that bold goal-setting by large funds is necessary to drive meaningful change. “We need bold targets at both the fund and portfolio levels. More women partners, more carry allocated to women, and portfolio benchmarks – like starting with 20 per cent women-founded companies, moving towards 50 per cent,” she said.

Separate data from Africa: The Big Deal shows that total startup funding across equity, loans and grants (excluding exits) is expected to grow to $3.2 billion in 2025, a 40 percent increase from $2.2 billion in 2024. The continued decline comes after funding fell to about $3.1 billion in 2023 amid global monetary tightening and valuation corrections.

Yet the recovery has done little to change the structural imbalances shaping Africa's venture capital landscape. For women-led startups, the funding rebound has so far reinforced rather than reduced existing inequalities, raising questions about whether Africa's next growth cycle will be meaningfully inclusive without deliberate changes in capital allocation.