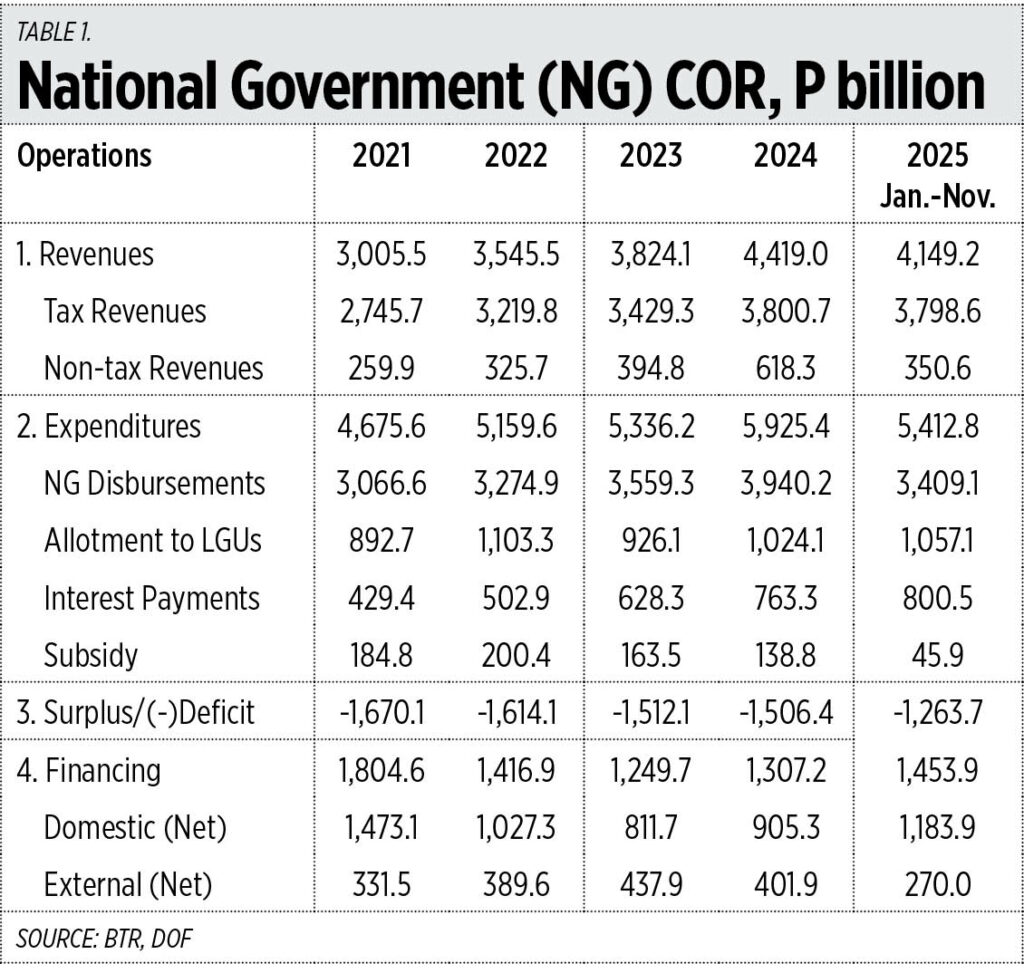

While waiting for the Bureau of the Treasury's (BTR) Full Year 2025 Cash Operations Report (COR), I examined the January-November 2025 data.FThe ICIT is P1.26 trillion and since national government disbursements in December reached around P600 billion while revenues were around P300 billion, the full-year deficit could reach P1.56 trillion.

The bulk of our budget deficit comes from interest payments alone, averaging P1.7 billion/day in 2023; P2.1 billion/day in 2024; and P2.4 billion/day in 2025. New financing or net borrowing in the first 11 months to 2025 was P1.45 trillion (See Table 1).

tobacco smuggling

Recently I saw that there have been many reports on tobacco smuggling. See how many stories appeared on this topic philippine star This month alone: “P1.5 billion smuggled cigarettes found in Malabon” (January 2), “3 held over P21.2 million smuggled cigarettes” (January 7), “Police seize P97.4-M worth of imported cigarettes in Maguindanao del Norte” (January 8), “P100.57 million smuggled cigarettes seized in Bataan” (January 11), “P20 million worth Smuggled cigarettes seized by police'' (January 12), ''Security officials flagged in illegal cigarette trade'' (January 20), ''House to probe pol on cigarette smuggling'' (January 22), ''Gatchalian wants Senate probe on tobacco smuggling'' (January 23), ''Senate eyes probe on 516 million illegal cigarettes'' (January 25); “Going after the smugglers” (“Commonsense” opinion column by Marichu A. Villanueva) January 23, and the January 26 editorial, “Going after the smugglers” (January 26).

Customs Commissioner Ariel F. Nepomuceno and Bureau of Internal Revenue (BIR) Commissioner Charlito Martin R. Mendoza's actions and the chairman of the House Committee on Ways and Means, Representative Miro S. Congratulations to Quimbo and the investigation conducted by Senator Sherwin T. Gatchalian, Chairman of the Senate Committee on Finance.

Citing calculations from both the BIR and the Bureau of Customs, Mr. Quimbo said that in 2025, there was a revenue loss of P44.8 billion from cigarette smuggling nationwide.

Mr. Gatchalian believes that “tobacco smuggling can only happen through collusion between politicians and law enforcement agencies.”

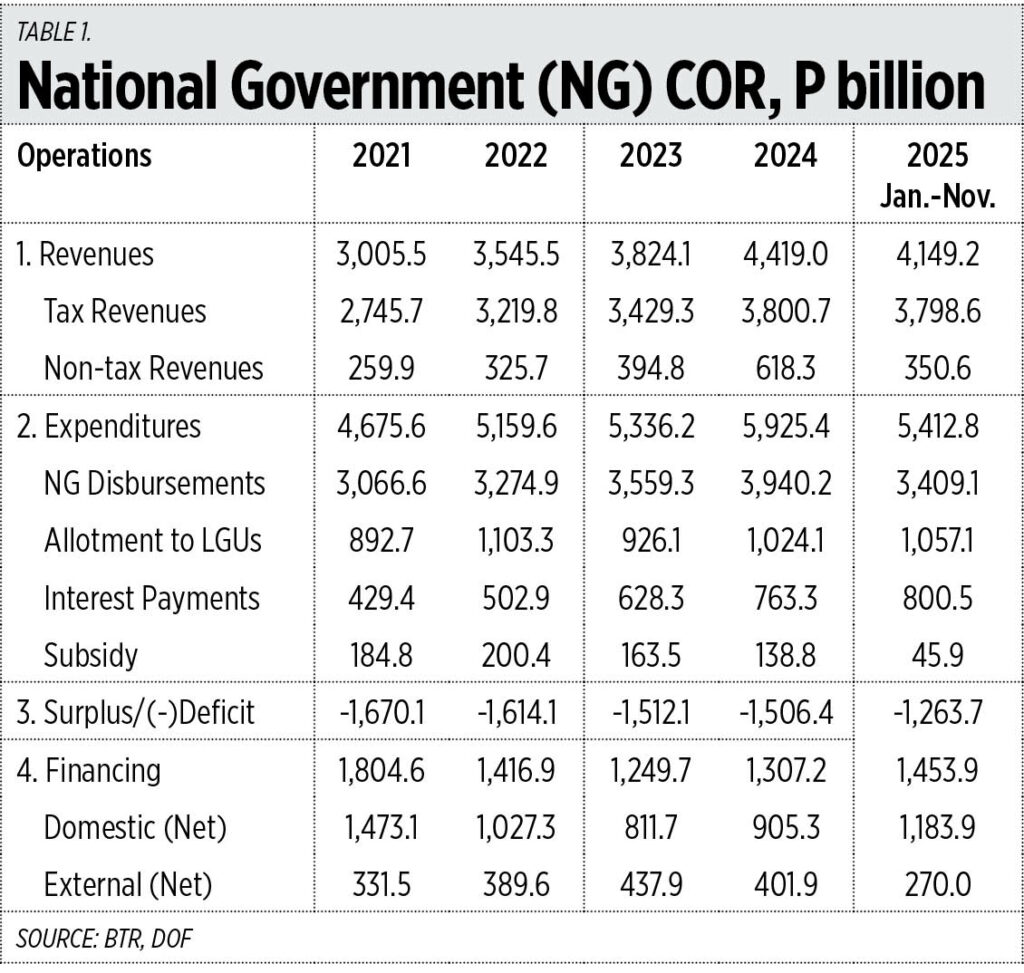

I believe the decline in the amount of tobacco tax revenue is coincidental, or directly caused, by the continued increase in the tobacco tax rate – from P50/pack which generated P176 billion tobacco tax revenue in 2021, to P63.20/pack which generated only P134 billion in 2024. Meanwhile, tax collections from liquor, sugar-sweetened beverages, mining and automobiles have either remained flat or are increasing somewhat (See Table 2).

Ordinary and poor smokers will not buy legal cigarettes at P100/pack or more because the tax alone is already P66.20/pack. Instead they will turn to smuggled cigarettes priced at P50/pack or less because the tax is zero. The BIR and the Department of Finance do not get anything from smuggled cigarettes to help finance public expenditures.

Reports or “studies” that claim “illegal tobacco trade in Metro Manila cities is less than 1%” are not accurate and here are two pieces of evidence.

One, during the public hearings of the Senate Committee on Finance chaired by Senator Gatchalian in March and May 2025, in both instances he instructed his employees to purchase smuggled tobacco in Quiapo. Within an hour, staff members returned with several illegal products, saying that those goods were easy to purchase, cheap, and were openly displayed and not hidden. Mr. Gatchalian displayed the newly purchased illicit tobacco to all participants in the committee hearing, including health workers and physicians, repeatedly arguing that the amount of illicit tobacco was underestimated and exaggerated.

Second, I personally saw such illegal products being sold when I went to Ongpin St. in Binondo, Manila to look for some jewelry for my daughter about two years ago. I saw a girl, who looked to be about high school age, openly displaying bundles of cigarettes that were clearly 100% illegal because they were (a) cheap, P60 or less if you bought more at the time (2024) when the tax rate was already P63/pack; (b.) there were no graphic warnings on the packs; and, (c.) many contained Chinese characters. The young girl's “stall” was less than 100 meters away from the nearby police station and barangay outpost.

The BIR and the Department of Finance can collect not only P134 billion/year, but also P176 billion/year or more from tobacco and help reduce the deficit and borrowings. How? I can think of two ways.

One, to reduce the price gap between legal and illegal cigarettes by bringing the tax rate down to P60/pack or less, reducing the temptation for smokers to patronize illegal tobacco, where government tax collection is zero.

Two, for vapes and heated products, reduce the opportunity for tax evasion by having a lower single rate or just two rates with less difference between the two rates.

The government should focus on controlling crimes – murder, robbery, destruction of property, kidnapping and rape – which harm other people. The government should step back from regulating people's actions that do not harm others except themselves – speeding downhill cycling, climbing tall trees, sedentary living, drinking alcohol, smoking, vaping, consuming fatty-oily-sugary foods and drinks, etc. Allow greater individual and parental responsibility for protecting personal and public health.

Bienvenido S. Opalas, Jr. Bienvenido S. Opalas, Jr. is president of Research Consultancy Services and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimum government@gmail.com