In boardrooms, investor roundtables and policy discussions, one topic continues to gain momentum, and that is impact finance. Quietly but steadily, it is emerging as one of the most transformative trends shaping the future of environmental, social and governance (ESG) practice in Africa.

At its core, impact finance represents a fundamental evolution in how we think about capital, accountability and value creation. Unlike traditional financing models, which measure success only by profit margins, impact-linked finance links investment returns to clearly defined sustainability outcomes. In simple terms, it rewards companies not only for their earnings but also for the positive change they make. Emissions are reduced, women are empowered, communities are uplifted, or forests are restored.

For a continent like Africa that simultaneously grapples with development and inequality, opportunity and insecurity, this change could be revolutionary.

Moving beyond compliance to measurable impact

For years, ESG conversations in Africa have been largely driven by compliance: reporting, disclosure and risk management. These remain critical, but they tell only part of the story. As regulators and investors demand greater transparency, the real question becomes: How do we translate ESG principles into tangible outcomes that create both financial and social value?

Impact-linked finance provides that answer. It brings together the objective of rigor and stability of finance. We are starting to see this through instruments like green bonds, sustainability-linked loans and hybrid finance structures that mobilize private capital for the public good.

These tools are not theoretical; They are working models that prove that sustainability and profitability can co-exist. For example, many African governments have already issued green bonds to finance renewable energy and climate adaptation projects. Also, corporate entities are beginning to structure loans where interest rates fall when sustainability goals are met.

This alignment of financial incentives with sustainability outcomes is not just innovative; This is transformative. This ensures that ESG becomes a value driver, not a checkbox.

Why does this matter to boards and business leaders?

For boards and senior leaders, this trend has deep implications. The question is no longer whether ESG matters or not; That debate has been resolved. The challenge now is how to integrate ESG performance into the financial DNA of the organization.

Boards should start asking:

-How can our ESG strategy attract catalytic capital?

-What measurable outcomes can we link to financing terms or investor participation?

-Are our governance systems strong enough to credibly track, verify and report these results?

Finance linked to impact will test leadership maturity. This requires foresight, strategic alignment and transparency. But it also presents a remarkable opportunity: to position the organization not only as a responsible corporate citizen, but as a sustainability innovator.

As investors increasingly prefer businesses that demonstrate real-world impact, leaders who can connect strategy, sustainability and finance will enjoy a clear competitive edge. In this new scenario, impact measurement has become the language of credibility and the currency of trust.

Ripple effect in all areas

The potential impacts of this trend in key regions of Africa are significant.

In energy, impact-linked finance can accelerate the transition to renewable energy by attracting mixed capital that de-risks early-stage clean energy investments.

In agriculture, it can reward sustainable farming practices that enhance soil health and food security.

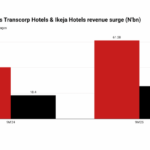

In manufacturing and real estate, it could boost investment in low-carbon technologies and green building standards. And in financial services, it could deepen ESG integration, leading banks to embed sustainability metrics into credit assessment and portfolio management.

Particularly for Nigeria, this trend aligns well with the government's push towards climate-resilient development and the private sector's growing interest in sustainable infrastructure, circular economy initiatives and social enterprise funding.

If strategically adopted, impact-linked finance can help unlock the trillions of naira needed to meet our climate, social and developmental goals, while also providing competitive returns for investors.

Governance: the cornerstone of credibility

However, none of this will work without governance. Strong, transparent governance remains the foundation of every credible ESG initiative. Boards should ensure that data integrity, ethical leadership and third-party verification underpin each impact-related transaction.

Impact finance thrives on trust. Investors will only commit capital if they are confident that reported results reflect reality. Therefore, governance must be supported by clear metrics, independent audits and open disclosure, as these will determine which organizations actually benefit from this trend.

It also requires capacity building in both the public and private sectors. Financial institutions, regulators and corporate leaders should deepen their understanding of sustainability metrics, impact assessment and ESG reporting standards. The ability to measure impact with integrity will set leaders apart from the laggards in Africa's sustainability journey.

Call to lead the next wave

Impact finance excites me because it marks the next phase of ESG development in Africa: the shift from compliance to competitiveness, from intention to innovation, and from reporting to actual impact.

It challenges us to reimagine value creation in a way that benefits business, people and the planet together. It also confirms that Africa does not need to follow the global ESG script; We can lead our own change by creating models that reflect our realities and ambitions.

For visionary leaders and boards, it is time to act. The future of capital is impact-driven, and those who get on board early will not only future-proof their organisations, but also help define the next era of sustainable African enterprise.

Sarah Esangbedo Ajose-Adeogun is the Founder and Managing Partner of Tisu Consulting Limited, a leading ESG consulting firm. He is a former Community Materials Manager at Shell Petroleum Development Company and has served as Special Adviser on Strategy, Policy, Projects and Performance Management to the Edo State Government. She is also the host of the #SarahSpeaks podcast on YouTube @WinningBigWithSarah, where she shares insights on leadership, strategy, and sustainable development.