…Low entry barrier, high ROI drives profitability

Nigeria's watermelon (egusi) industry is quietly becoming one of the country's most lucrative agribusiness sectors, as growing demand, low entry barriers and high returns attract both farmers and investors, experts say.

Recent data from food data hub, TRIZ, shows that Nigeria produces about 573,000 metric tonnes of watermelon annually, while local demand reaches about 1.039 million metric tonnes based on Foraminifera Market Research data. This leaves a supply gap of approximately 466,000 MT, highlighting a significant untapped market potential.

The commodity is now selling at N1.3 million per tonne as of October 29, 2025, valuing the total production at about N744 billion annually. Experts say this is a small part of the target that can be achieved if the country closes its supply gap and increases exports.

With prices of traditional food items like maize and rice falling amid increased imports and bumper harvests, many farmers are turning to watermelons as a profitable alternative. Unlike cereals, watermelon offers low input costs and fast turnover.

Also read: Egusi Soup – the proudly Nigerian superfood that could achieve UN cultural status

“Ninety-eight percent of watermelon cultivation, harvesting and processing in Nigeria is still done manually because there are no modern technologies that have been proven to work for harvesting watermelons – which is a huge opportunity for smart investors,” David Nkwa, CEO of agri-investment company DNfood Global Ltd., said in a phone conversation.

He further said, “Storage of melons can offer 25 per cent to 100 per cent or even more depending on the quality, location, storage time and market access.”

Industry players say most melons are still exported informally, while local processing remains largely undeveloped. He argues that this represents one of the biggest growth limitations in Nigeria's non-oil sector.

“There is no time when demand for watermelon is not high, because at the moment, Nigeria is the largest producer globally, with 65 percent-70 percent market share,” said aggregator and investment consultant Tsekohole Dennison.

He explained that egusi is not just a Nigerian dish but a regional and global dish. “I have been to Ghana, and the rate at which they eat melon dishes is quite alarming. Nigerians in the diaspora also love Egusi soup, making it a good export commodity and a huge market opportunity for investors.”

A study by Francis Ojadi at IntakeOpen found that about 50 percent of Nigerian households and eateries regularly consume egusi. “With over 40 million households, even if 25 per cent buy only 250 grams (two cups of milk or half a derricka of peeled egusi) weekly at N1,000, the domestic market alone can generate N10 billion weekly, and if half the households consume that much, can generate N20 billion,” wrote an X user.

As National Bureau of Statistics (NBS) data shows, the average Nigerian household has 5.06 persons and a dependency ratio of 0.97 – figures that underline why affordable, high-yield crops like watermelon are becoming more attractive.

Government policy changes are tipping the scales further. In 2024, the federal government granted N97 billion import rebate on rice, maize and sorghum for 150 days, which helped lower food prices but caused significant losses to local farmers.

For context, maize prices fell from N120,000 per 100 kg bag in 2024 to about N75,000-N80,000 in 2025, while paddy rice fell from N100,000 per 100 kg bag to between N50,000 and N60,000. In stark contrast, melon prices have increased from N120,000 to about N250,000 per 100kg bag – an increase of over 100 per cent – a testament to its growing market power.

From the farms of Benue or Nasarawa, to the kitchens of Lagos and expatriate homes in London and Atlanta, watermelon is fast becoming much more than just a soup seasoning. It is an agricultural goldmine waiting to be fully unlocked.

Economics of melon cultivation, storage

Experts say watermelon (egusi) farming is fast emerging as one of Nigeria's most promising agribusiness opportunities due to its low input costs, short growth cycle and high returns.

With a maturity period of only three months to four months, Watermelon offers quick turnaround for investors seeking fast cash flow. Dennison, quoted earlier, explained, “Planting is done between April and July, while harvesting begins in August to November, depending on the time of planting.”

Farmers say that unlike many crops, muskmelon is naturally safe from grazing animals, as its mature leaves emit a strong odor that repels cows and goats. A well-managed hectare can yield about one ton of watermelon, depending on the variety and farming methods.

Experts recommend improved varieties, which require weeding twice during the growth period – or just once if intercropped with maize. Optimal planting involves two to three seeds per hole, sown 1.5 cm–2 cm deep and spaced about one meter (three feet) apart.

According to Jaytermax Integrated Enterprise, as of October 29, 2025, one tonne of pitted watermelon sells for about N1.3 million.

Apart from farming, storage is a major profit driver. Depending on quality, timing and market access, stored watermelons can give returns of 25 percent to 100 percent or more in just a few months.

Nkwa outlined the key success factors to maximize investors' profits.

“Before storing melons, you must buy in peak season, buy the right quality, estimate profits, understand market dynamics, identify your buyers and sell at the right time,” he said.

According to experts, the ideal buying window is from September to early December, when supplies peak and prices fall. “Always select dry, well-seeded, shiny quality melons that are easily sold in the market,” Nkwa advised. He issued a warning: “In this business, you must not be greedy, otherwise you may lose.”

Location also determines profit margin. Dennison said, “Sourcing from a local market and selling in cities is a way to make huge profits. Prices vary widely from state to state.”

The major producing states—Niger, Benue, Nasarawa, Taraba and Kogi—serve as supply centers for traders who resell in high-demand markets in the cities. “Just sourcing from a local market in Nasarawa and selling in Abuja makes me huge profits,” one aggregator shared.

For newcomers, the entry fee remains accessible. “You can start with a minimum amount of N1 million to N5 million for watermelon storage. As a beginner, it is important to start small and scale up,” Nkwa advised.

With growing domestic demand, strong diaspora consumption and widening supply gaps, watermelon cultivation and storage are proving that in Nigeria's agricultural landscape, egusi could be the next cash crop success story.

Also read: Nigerian scientist sends Igusi into space for the first time in Africa

Challenges

Experts say harvesting of melons remains a labour-intensive process, with about 98 per cent still done manually. Despite its profitability, the sector faces constraints such as poor storage infrastructure, post-harvest losses and high logistics costs that are impacting farmers' margins.

To prevent these losses, experts recommend a strategic buying and selling cycle – buying at the peak of the crop season when prices are low, and selling when demand increases, such as during festive periods or at the beginning of the planting season.

“Storage should be done in a well-ventilated house with regular monitoring,” advised Dennison, emphasizing that proper management and timing are important to maximize returns in the watermelon business.

global perspective

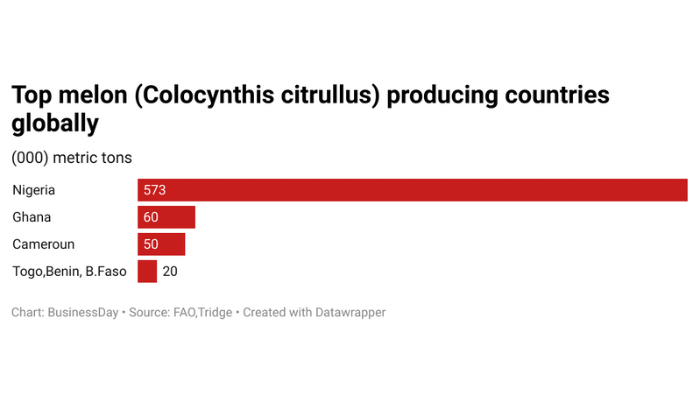

Nigeria remains the largest producer of melons (Colocynthis citrullus L.) in the world, accounting for about 65 percent-70 percent of the global supply, with annual production estimated at 570,000 metric tons to 573,000 metric tons. According to TRIZ data, output has remained relatively stable, showing growth of only 1.2 percent between 2015 and 2025.

Other major producers based on FAO and TRIZ reports include Ghana (35,000–60,000 metric tons), Cameroon (35,000–50,000 metric tons) and Togo, Benin and Burkina Faso (10,000–20,000 metric tons). Major export destinations span Asia, South America, Europe, North America and other African markets.