Yields on government securities (GS) traded in the secondary market remained mixed last week as the market awaited US consumer price index (CPI) data to be released late on Friday.

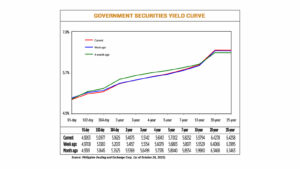

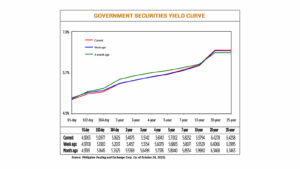

Based on PHP Bloomberg Valuation Service reference rates as of October 24 published on the website of the Philippine Dealing System, GS yields, which move inversely to prices, declined an average of 0.22 basis points (bp) week on week.

At the short end of the curve, yields on 91-, 182-, and 364-day Treasury bills (T-bills) declined 4.45 bps (4.9263%), 4.03 bps (5.0977%), and 4.05 bps (5.1626%), respectively.

Meanwhile, on stomach, rates mostly rose. Yields on four-, five- and seven-year Treasury bonds (T-bonds) rose 0.64 bps (5.6143%), 1.19 bps (5.7002%), and 1.81 bps (5.8252%), respectively. On the other hand, two- and three-year papers saw their rates decline by 0.82 bp to 5.4075% and 0.12 bp to 5.5142%, respectively.

Finally, at the long end of the curve, the 10-, 20- and 25-year notes climbed 2.65 bps, 2.12 bps and 2.63 bps to yield 5.9794%, 6.4278% and 6.4258% respectively.

GS trading volume declined to P28.52 billion on Friday from P50.28 billion a week earlier.

Yield movements were mixed as markets continued to rise domestically and domesticallyThe development of the ocean, analysts said.

“Shorter-terms have been reflecting recent rate cuts, while longer-terms have been stomping on profit-taking,” one bond trader said in a Viber message.

The trader said players remained cautious ahead of the release of key US inflation data on Friday evening as these could influence the Federal Reserve's policy decision at its October 28-29 meeting.

“Flush liquidity conditions and limited bond supply have continued to support the front end, keeping yields steady as investors still brace for potential monetary policy easing amid looming growth concerns,” Lodavico M. Ulpo Jr., vice president and head of fixed income strategies at ATRAM Trust Corp., said in a Viber message.

“In contrast, the uptick in the bailout and long end reflected a more defensive stance in line with volatility in global bond markets, as participants priced in expectations of an increase in domestic bond supply from the bailout to the long end in the coming weeks and adjusted due.Ration risks accordingly.

The Bangko Sentral ng Pilipinas (BSP) cut benchmark interest rates by 25 bps for the fourth consecutive meeting this month, bringing the policy rate to a three-year low of 4.75%. This has cut borrowing costs by a cumulative 175 bps since the rate cut cycle began in August 2024.

BSP Governor Eli M. Remolona, Jr. has left the door open to more cuts in the coming months to support the economy amid weakening prospects as governance concerns over a corruption scandal involving state infrastructure projects have weighed on investor sentiment.

The next meeting of the Monetary Board to discuss policy will be held on December 11.

Meanwhile, U.S. consumer prices rose slightly less than expected in September as gasoline price increases were partly offset by a sharp decline in fares, putting the Federal Reserve on track to cut interest rates again this week, Reuters reported.

The report was published despite an economic data blackout caused by the U.S. government shutdown to help the Social Security Administration calculate 2026 cost-of-living adjustments for millions of retirees and other benefit recipients who will get a 2.8% raise.

It was initially scheduled for October 15 and the White House warned that the October inflation report would not be published for the first time because the shutdown had halted data collection.

The Labor Department's Bureau of Labor Statistics (BLS) said the consumer price index rose 0.3% last month after climbing 0.4% in August. The BLS said CPI data collection was completed before the shutdown. Nevertheless, as the statistical agency used imputation to fill in missing information, the share increased from 36% to 40% in August. A 4.1% jump in gasoline prices was the main driver of the CPI increase.

In the 12 months to September, the CPI rose 3.0% after rising 2.9% in August. Economists polled by Reuters had expected the CPI to rise 0.4% monthly and 3.1% on a year-on-year basis.

Excluding volatile food and energy components, the CPI rose 0.2% after rising 0.3% in August. Slow fare inflation led to a decline in the so-called core CPI.

The Fed tracks the personal consumption expenditures (PCE) price index for its 2% inflation target. Based on CPI data, economists estimate that core PCE inflation rose 0.2% in September, a year-on-year gain of 2.9%.

However, the ongoing shutdown will delay the release of that data. The shutdown, the second longest in history, is raising concerns over the quality of future inflation reports, given the suspension of collection efforts.

Mr. Ulpo said business sentiment was “dim” last week, as reflected in the results of the Treasury Bureau's bond auctions.

“The seven-year T-bond was delivered broadly in line with market expectations, while the 25-year tranche was priced around 10 bps above secondary market levels, underscoring investors' cautious stance amid a lack of strong conviction,” he said. “Average daily trading volume declined sharply to P35 billion from P75 billion last week, as market participants opted to stay on the sidelines ahead of key global data releases.”

“Externally, global macro uncertainty continues to weigh on local sentiment. The ongoing US government shutdown has delayed the release of key economic indicators, introducing an additional layer of uncertainty for investors. This information gap complicates the US Federal Reserve's policy calibration. The resulting volatility and cautious global tone has spilled over into the local fixed-income sector, further reducing risk appetite.”

As for this week, the US inflation report released over the weekend could impact GS yield movements, both analysts said.

“Market direction will depend on that report, but there remains a bias towards lower yields given the absence of new supplies and lingering growth concerns,” the trader said.

“We expect the local bond market to remain subdued with limited directional bias as investors await clear catalysts. Domestic factors are likely to remain subdued, and focus will shift to key US data releases,” Mr Ulpo said.

He said the softer-than-expected September US consumer inflation print “could strengthen expectations of a more dovish Fed stance, providing support for global bond markets and potentially inspiring renewed buying interest locally.” , heather Caitlin P. Manago with reuters