First Central Credit Bureau, Nigeria's first private credit bureau, has marked its twentieth anniversary with a four-day celebration that combined learning, innovation and recognition.

The event, tagged “Global Credit Connect,” included a mix of training sessions, product showcases and industry discussions. It brought together representatives of commercial banks, microfinance institutions and other players in the credit ecosystem.

The event ran for four days, with the first three days dedicated to virtual free training on credit service management aligned with the ITIL4 framework. Grand celebrations were held on the final day, 17 October, concluding the milestone anniversary.

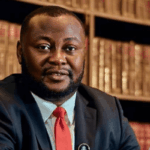

In his opening remarks during the celebration, company director Olufemi Blaise reflected on the bureau's evolution over two decades. He said the company is now leveraging AI-powered analytics to improve credit decision making.

“We are accelerating our research and development efforts in artificial intelligence and related technologies to remain at the forefront of market innovation,” he said.

A highlight of the festival was a panel session moderated by Owen Arsomwan of First Central. These include Adebimpe Odunuga, Group Head of Risk Management at FCMB Group; Henry Obiekeya, Managing Director of Fairmoney Microfinance Bank; Gbenga Balogun, Head of Credit Administration at FirstBank of Nigeria; and Bola Oduyale, managing director of CreditWise.

Panelists discussed the future of the credit system in Nigeria. He shared insights on data integration, risk transparency and financial inclusion in the rapidly changing digital economy.

The company also showcased new products and services. Mary Ohlete Uwaoma, General Manager, Marketing and Business Development, unveiled the “Automatic Loader”, a do-it-yourself tool that processes user data seamlessly. They also introduced the FirstCentral mobile app, which is now available on the App Store and Play Store.

The app allows individuals and SMEs to check their credit scores and manage credit-related services easily anytime and anywhere.

A journey of innovation

Established as XDS Credit in May 2005, First Central Credit Bureau made history in 2009 when it became Nigeria's first licensed private credit bureau following approval from the Central Bank of Nigeria.

According to Oladimeji Peters, the company's managing director, the bureau now has over 2 billion historical records and over 40 million unique customer profiles.

Peters enumerated the company's major milestones. A data center was built in 2014. In 2015, the firm expanded into the non-financial sector. By 2016, it had ventured into leasing and insurance. “In 2018, we rebranded to First Central Credit Limited,” he added.

Keynote “Is Your Credit Model Ready for Future Disruption?” The talk on the topic was delivered by Ubong Essien, Dean of the School of Eloquence.

Essien urged industry players to use artificial intelligence to increase access to credit. He also took inspiration from the story of Bangladeshi economist Muhammad Yunus, who pioneered microfinance and transformed access to credit for low-income people.

“AI can now catch trends that traditional models were built to miss,” he said. “The challenge for the next decade is to ensure that innovation translates into financial inclusion.”

The celebration ended with the presentation of the awards, where the Bureau's partners over the twenty-year journey were recognized.