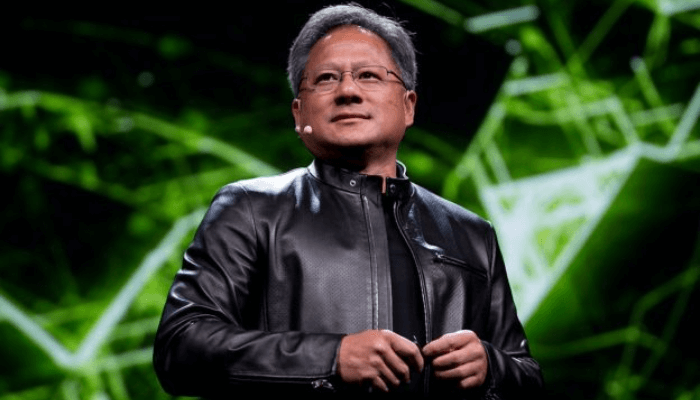

Jensen Huang, chief executive of chip-making giant Nvidia, traveled to Asia on Wednesday to meet with President Trump, his company valued at more than $5 trillion. This was a display of wealth that could not have been imagined a few years ago.

But that was before the ChatGPIT chatbot ignited an artificial intelligence boom that was remaking the global economy. This was before other tech giants began spending hundreds of billions of dollars on construction projects on nearly every continent. And that was before Nvidia's computer chips, the most essential and expensive component in nearly every AI plan, became the pivot of the Trump administration's foreign policy.

Also read: OpenAI will create autonomous AI researchers by 2028- Altman

Nvidia's milestone as the first publicly traded company with a market cap above $5 trillion is indicative not only of the astonishing level of wealth among a handful of Silicon Valley companies, but also of the strategic importance of this company, which has added $1 trillion in market value over the past four months.

Nvidia has become a driving force behind the US economy. Spending on data centers filled with company chips accounted for 92 percent of the country's gross domestic product growth in the first half of the year, according to Jason Furman, a professor of economic policy at Harvard. Without it, the economy would have grown 0.1 percent.

But Nvidia's astonishing rise also brings a warning to investors, from Wall Street's biggest banks to small traders on Main Street, that the stock market is becoming more and more dependent on a group of technology companies that are making billions in profits and spending to develop an unproven technology that is supposed to deliver huge returns.

“There is unbridled optimism about where this technology will go,” said Gene Munster, managing partner of Deepwater Asset Management, which invests in emerging technology companies. “But the question is: Will it deliver results? The usefulness of AI today is still limited.”