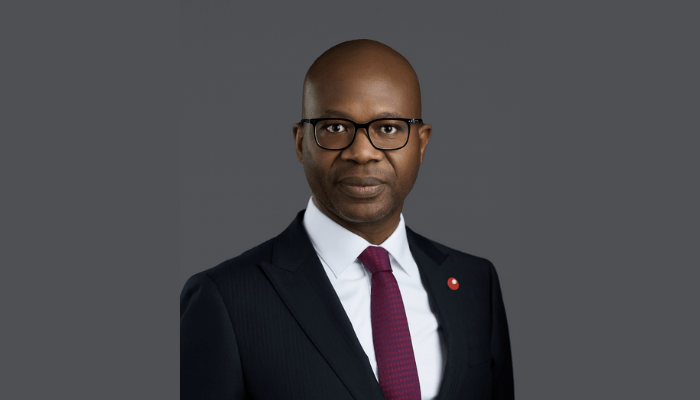

Sterling Financial Holdings Company PLC (Sterling Holdco) has successfully completed its recapitalization mandate, strengthening investor confidence and funding its strategic ambitions.

The Group's recapitalization journey emphasizes that in an environment of regulatory change, a measured, transparent and well-indexed capital strategy can be a powerful tool for value creation; Thereby providing an attractive case study in strategic capital management.

The March 2024 directive of the Central Bank of Nigeria (CBN) to recapitalize banks served as a strategic litmus test for the entire industry. While the initial response was a flurry of public fundraising goals and announcements, more instructive developments have unfolded organically behind the scenes. A closer examination of Sterling Financial Holdings Company's (Sterling Holdco) approach reveals a calibrated strategy that other financial groups would be wise to study.

From the beginning, Sterling Holdco treated the N200 billion capital requirement as an integrated financial challenge involving its two banking subsidiaries. The holding company's response was a structured, three-tranche capital raising programme, comprising a N75 billion private placement, a N28.79 billion rights issue and an N88 billion public offer. This phased execution allowed for strategic capital allocation between Sterling Bank and the Alternative Bank to mitigate risk and maintain strategic momentum.

Also read: Investors race for Sterling Holdco shares

Phased execution…

The first tranche, the N75 billion private placement, is due to conclude in September 2024. The operating result was a net increase of N73.86 billion. The strategic decision taken thereafter was: the deliberate allocation of N68.8 billion to Sterling Bank as well as capital investment of N5 billion in the alternative bank. This immediate action strengthened the regulatory position of both institutions and demonstrated a clear prioritization of resources.

The subsequent rights issue in October 2024 provided an important market-based validation of the group's strategy. The oversubscription of N10.29 billion indicated strong investor confidence. The regulatory approval in May 2025 for the N26.639 billion allocation and the restructuring of the excess in the private placement demonstrated regulatory agility. The concrete outcome was that Alternative Bank achieved its full capital mandate, while Sterling Bank's capital shortfall was substantially reduced to N53 billion.

Victory in Investor Relations, Market Timing…

An important and often overlooked aspect of this process was the management of the N10.29 billion oversubscription from the rights issue. Sterling Holdco's decision to seek approval to convert this additional amount into a private placement was a masterstroke in investor relations. The move guaranteed that all subscribers who showed confidence in the offer price of N4 per share received the full allocation, honoring their commitment and strengthening confidence.

The length of time to wait for regulatory approval became an indicator of underlying strength. The group's solid fundamentals and strategic progress led the market to rise, causing the share price to almost double. This substantial re-rating provided solid rewards to loyal shareholders and created powerful momentum for the next phase.

Taking advantage of this positive market sentiment, the Group made a bold strategic move. Even before it received final approval for the private placement, it had launched an N88 billion public offering, keeping the subscription window open for only two weeks.

This action, taken with confidence, which differentiated the group from other players, was a strategic move supported by the demonstrated market performance. The rapid and positive investor response reaffirmed the deep confidence in the Group's direction and ability to execute.

Final installment, forward-looking deployment…

With the recent regulatory finalization of the N10.29 billion private placement due in October 2025 and the injection of N10.11 billion into Sterling Bank, the group's capital position stands at N157 billion. The remaining N43 billion requirement is set to be met from the proceeds of the successfully completed public offering, which is now awaiting final regulatory approval.

Importantly, this strategy extends beyond mere regulatory compliance. The plan to infuse an additional N10 billion into its wealth management subsidiary, SterlingFI, and allocate the remaining balance to ecosystem expansion reflects a forward-looking agenda. This capital holding enables the company to finance its future growth engines while ensuring compliance with CBN requirements.

Also read: Sterling Holdco's public offer opens at N7 per share

H1'25 Scorecard in Review…

The group had a strong performance in the first half of the year (H1) following a successful private placement and rights issue. Sterling Financial Holdings Company PLC reported a 157 per cent year-on-year (YoY) growth in profit after tax (PAT) in its unaudited results for the half year (H1) ended June 30, 2025.

The company demonstrated continued momentum in revenue growth, operating efficiency and capital position. The Group's PAT increased to N41.78 billion from N16.26 billion in the same period last year. Earnings per share increased from 56 kobo to 89 kobo, reflecting continued growth in value for shareholders. Gross income increased by 39.7 per cent to N212.61 billion compared to N152.20 billion for the first half of 2024, while interest income increased by 38.3 per cent to N167.16 billion, and non-interest income increased by 45 per cent to N45.45 billion, attesting to the group’s strategic focus on revenue diversification. Additionally, the group's cost-to-income ratio increased from 75.7 percent to 64.5 percent, underscoring the benefits of ongoing cost optimization measures.

“Our excellent half-year results are the product of a clear strategic focus and a sustained drive to create sustainable value for our stakeholders. Our performance reflects not only strong growth in core income lines, but also our success in building a flexible and agile business model, capable of delivering superior returns even in a dynamic macroeconomic environment.

“As we continue to diversify our income streams and invest in operational efficiency, we stand firm on our commitment to responsible growth, prudent risk management and sustainable impact.

“As we look to the next phase of our capital programme, we see tremendous opportunity to deepen our footprint in Nigeria’s growth sectors and catalyze meaningful progress for our customers, communities and the wider economy,” said Yemi Odubiyi, Group Chief Executive Officer, Sterling Financial Holdings Company.

Total assets stood at N4.08 trillion at the end of June, representing an increase of 15.3 per cent from N3.54 trillion in December 2024. Shareholders' funds grew 22.9 per cent for the period, reflecting the impact of the recent recapitalization and healthy retained earnings. Asset quality also improved, with the non-performing loan ratio reducing from 5.4 per cent to 5.1 per cent at the end of the 2024 financial year.

Bullish forecast in Q4'25…

Recently, Sterling Financial Holdings Company PLC released its cash flow projections for the fourth quarter ending December 31, 2025. According to its latest earnings forecast on the Nigerian Exchange, the company has estimated gross income of N149.267 billion and profit before tax of N22.580 billion for Q4'2025.

Shareholders are still being rewarded…the stock is near 52-week highs…

For the period ending December 31, 2024, Sterling Holdco paid a final dividend of 18 kobo on each 50 kobo ordinary share. The dividend was paid on July 11 to shareholders whose names appeared in the register of members at the close of business on July 1, 2025. Sterling Holdco traded at N8 per share traded on Friday, October 24, representing 42.86 per cent year-on-year (YtD) growth. At that price, the stock is close to its 52-week high of N8.97, while the 52-week low is N4.34. It has 52,117,012,414 shares outstanding.

Ensuring customers true financial freedom…

In an era when bank customers complain about numerous charges, Sterling Bank, one of the banking subsidiaries of Sterling Financial Holdings Company Plc, has announced the removal of Account Maintenance Fee (AMF) on all personal accounts, another bold step in its quest for customer-centric banking in Nigeria.

Sterling notes that every fee they eliminate is one less barrier between their customers and true financial freedom, noting that this was the reasoning behind eliminating transfer fees in April, and it's the same principle Sterling has maintained as it eliminates bank account maintenance fees.

The group's phased capital increase offers a blueprint for balancing compliance, investor relations and growth amid regulatory change. As the chapter closes on the recapitalization, the market will be keeping an eye on how this strong capital base is leveraged to drive the next phase of growth.