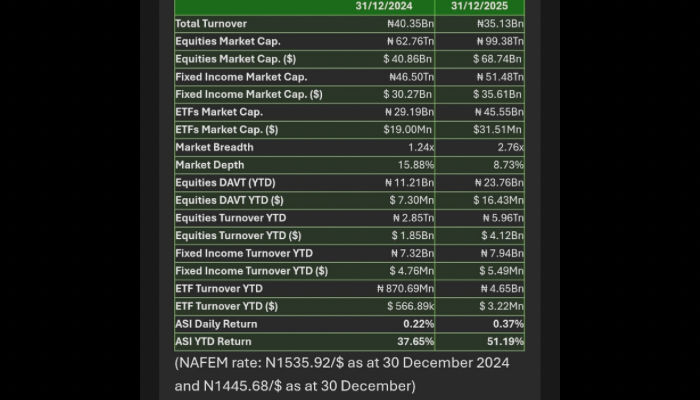

…YtD ASI growth 51.19%

The year 2025 is a remarkable year for Nigerian stock investors who saw their investments increase by 51.19 percent compared to 37.65 percent in 2024.

Also, the market value increased to N36.62 trillion in 2025 as capitalization reached N99.4 trillion against a 2024 low of N62.76 trillion.

Speaking on the achievement in 2025, Group Managing Director/Chief Executive Officer, Nigerian Exchange Group (NGX Group), Temi Popoola, said “the Nigerian capital market in 2025 demonstrated resilience despite domestic and global economic headwinds”.

He said that “this performance underlines the importance of policy stability, purposeful reforms and strategic cooperation in strengthening investor confidence and sustaining market growth”.

“During the year, efforts to advance economic reforms and improve market structures helped support a stable environment for capital formation, while our continued investment in technology played a key role in expanding access, enhancing transparency and improving operational efficiency across the market.

Also Read: Top 10 FMCG Stocks That Double Investors' Money in 2025

“As we look towards 2026, NGX Group is focused on deepening partnerships with regulators, issuers, market operators, policy makers and the broader financial ecosystem to maintain this momentum. We are optimistic about the opportunities ahead and are committed to positioning the Nigerian capital markets as a key driver of economic growth and wealth creation while furthering NGX Group’s vision as Africa’s preferred exchange hub.”

According to Lizzie Kings-Wally, CEO of 4Stone Capital Limited, “All Naira-assets were repriced in 2025 and this can be largely justified by the delayed impact of the 2023/24 devaluation of the Naira as well as inflationary pressures”.

“The equity market rallied despite an average yield of 20 per cent on fixed income assets. Other alternative assets, including real estate portfolios and commodities, also delivered strong returns in the year. That said, I remain cautiously optimistic on Nigerian equities, given its discounted valuations to peer emerging and frontier markets.

For example, the NGX All Share Index is still priced at barely an 8x price-earnings ratio, while the MSCI Emerging and Frontier Markets indices have P/Es of 16.5x and 12.1x respectively. Financial services stocks, especially tier-1 banks, are incredibly cheap, with Zenith Bank and United Bank for Africa trading at more than a 55 percent discount to their respective book values and low single digit forward P/Es of 4x. I am excited about this. Industries like Dangote Cement”, he added.

Also Read: Fast-moving consumer goods stocks should see upside ratings in 2026 – Kings-Wally

“As inflationary pressures ease and consumer purchasing power improves, I believe fast-moving consumer goods stocks should see upside ratings. Given the forecast of lower interest rates, investors may be better off locking in the current high yields on fixed income securities, as the inverted yield curve reinforces expectations of a lower yield environment in 2026,” Kings-Walley said.

“While the fiscal deficit and elevated levels of public sector borrowing may seem contrary to my expectation of lower yields, banks' risk-off sentiment and increased money supply will support my view. I expect tighter money supply and lower inflation to underpin potential returns on alternative assets, including real estate,” she said.