By Isa Jane D. Akabal, researcher

philippine economy Expansion is likely to slow in the fourth quarter of 2025, reducing full-year growth government's target among Corruption scandal, analysts said.

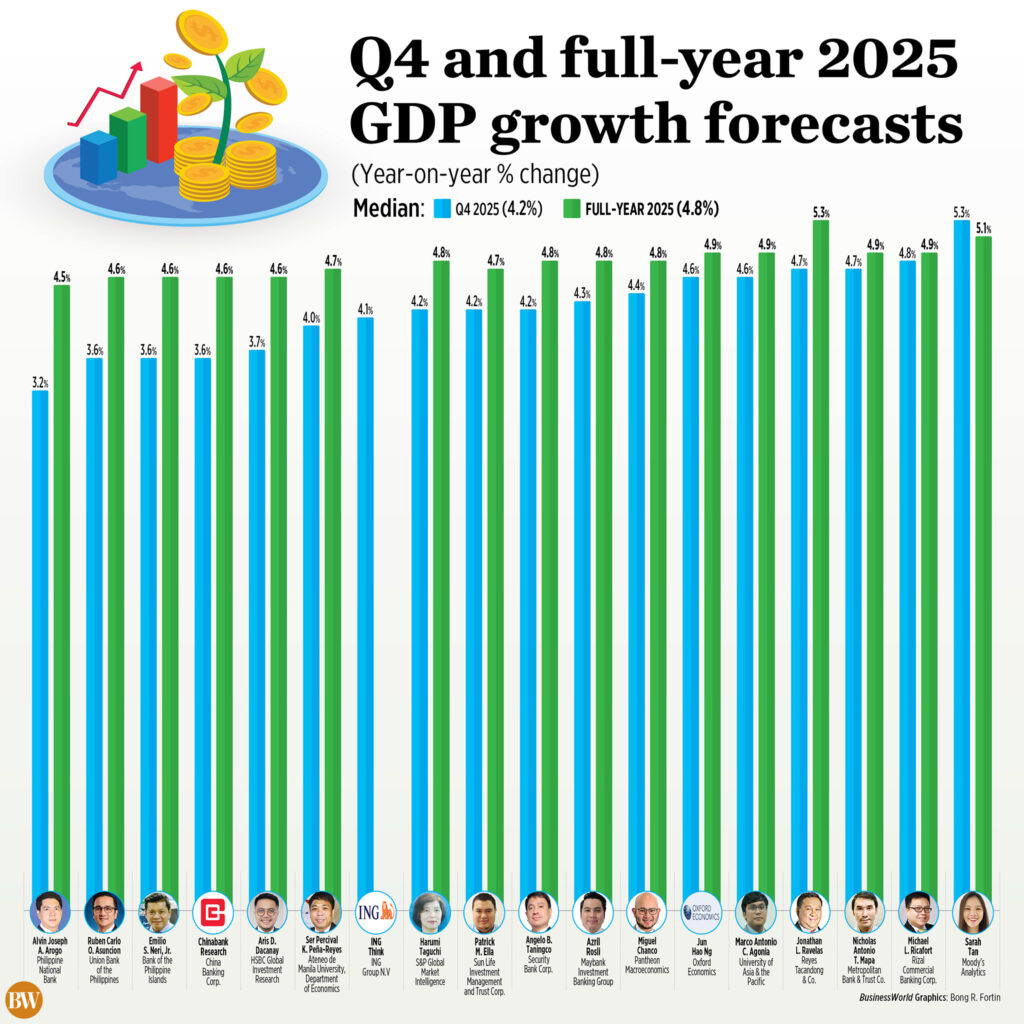

According to the average forecast of a survey of 18 economists, gross domestic product (GDP) could grow by an annual 4.2% from October to December. Businessworld.

If realized, growth is much slower than the 5.3% expansion in 2024 over the same period. Quarter on quarter, GDP growth in the third quarter accelerated from a four-year low of 4%.

This would bring average projected growth for the full year 2025 to 4.8%, which would miss the Development Budget Coordination Committee's 5.5%-6.5% growth target.

If realized, it would be slower than the 5.7% expansion in 2024 and the weakest since the 9.5% contraction posted in 2020.

The full-year GDP estimate is also below the forecasts of the Asian Development Bank (5%), World Bank (5.1%), International Monetary Fund (5.1%) and ASEAN+3. macroeconomicFIce (5.2%).

Philippine Statistics Authority (PSA) to release fourth quarter and full year 2025 GDP data on Thursday, January 29.

Harumi Taguchi, chief economist at S&P Global Market Intelligence, said weak government spending is the main factor hampering growth in the fourth quarter and the full year.

“We anticipate weak government spending and public fixed investment, reflecting the impact of ongoing corruption issues,” he said in an e-mail.

A widespread controversy linking public works officials, lawmakers and private contractors to corruption involving billions of dollars in unusual flood control projects hit government spending and household consumption. The Independent Commission for Infrastructure (ICI) has been These allegations are being investigated.

Government spending in November fell for the fourth consecutive month to P498.31 billion, down 9.6% year on year.

“On government spending, we will probably see more of the real short-term damage being indirectly caused by the formation of the ICI and the investigation, which actually started at the end of the third quarter (Q4), so we should bear the brunt of this natural lull and hesitation on the part of both public and private developers,” said Miguel Chanco, chief emerging Asia economist at Pantheon Macroeconomics.

Ruben Carlo O., Chief Economist of Union Bank of the Philippines. Asuncion said the slow annual GDP growth reflects the impact of the corruption scandal.

“The weakness reflects the wider fallout from the flood control corruption investigation, which has fallen short Public Works, Delayed Fiscal disbursements, and consumer and business sentiments were hit hard by the end of the year,'' he said. ''High-frequency indicators also reflected sluggish household spending and soft labor-market conditions as unemployment increased. Above and employment creation stopped.

Patrick M. Ella, an economist at Sun Life Investment Management & Trust Corp., said the decline in consumer and investor confidence following the corruption scandal “has manifested in slower consumption and a contraction in private investment.”

Marco Antonio C. Agonia, an economist at the University of Asia and the Pacific (UA&P), said, “The decline in government spending following the increase in distribution checks hit the economy hard in the year. The impact of the government spending multiplier declined, reducing aggregate demand and hurting economic growth.”

Security Bank Corp. chief economist Angelo B. According to Taningco, in addition to weak government spending, natural disasters hindered infrastructure development and economic activity.

As recorded by the State Weather Bureau, in 2025, a total of 23 tropical cyclones entered the Philippine area of responsibility.

Ms. Taguchi said natural disasters have also negatively impacted agricultural production, disrupting supply chains and impacting manufacturing, tourism and retail sales.

“We are projected to see moderate growth in private consumption and private investment due to adverse weather conditions in the fourth quarter of 2025,” he said.

rate cut

Maybank Investment Bank economist Azril Rosli said GDP growth was mainly due to a decline in inflation, “resilient” private consumption due to rate cuts by the Bangko Sentral ng Pilipinas (BSP) and a “modest” improvement in net exports.

Inflation rose from 1.5% in November to 1.8% in December, bringing average inflation for the full year to 2025 to 1.7% – the slowest pace in nine years.

“The slowdown in inflation over the past few months was the result of favorable base effects and the continued decline in rice and energy prices,” Nicolas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co., said in an e-mail.

“A quick move to a more accommodative monetary stance will help in rapidly boosting investment momentum,” he said.

The BSP has cut key borrowing costs by a total of 125 basis points in 2025, bringing the key policy rate to a three-year low of 4.5%.

“The BSP's interest rate cuts have so far had no meaningful impact on economic growth, and this reflects how weak 2025 was overall. The transmission of rate cuts to stronger activity in the real economy is naturally quite long for emerging markets like the Philippines, something the BSP is well aware of,” said Mr Chanco of Pantheon Macroeconomics.

UA&P's Mr Agonia said the impact of rate cuts on the real economy is minimal in the short term as there is a lag of one and a half to two years in monetary policy actions.

“A rate cut in 2025 is likely to deliver a clear boost to economic performance in the second half of 2026 and into 2027,” he said.

At the same time, strong exports and a low trade deficit have driven GDP growth amid “strong external demand for semiconductors and ongoing diversification efforts amid protectionist policies”. [United States]” ChinaBank Research said.

Preliminary data from PSA showed that the country's balance of goods trade – the difference between exports and imports – narrowed year-on-year to $3.51 billion in November from a deficit of $4.19 billion in October.

Exports rose 21.3% to $6.91 billion in November, higher than the 20.3% growth recorded in October. This was mainly due to a 50.6% increase in electronic products to $4.19 billion.

“Moderate global growth limited our projected export growth in 2025, although the impact of U.S. tariff increases has been smaller than anticipated,” S&P Global's Ms. Taguchi said.

Recovery in 2026?

This year, economists expect a gradual improvement in GDP growth as the government implements catch-up spending.

“To boost growth in 2026, the policy focus should shift to stronger fiscal execution, accelerated infrastructure and energy investment, enhanced disaster resilience, and deep structural reforms to crowd in private investment and improve export competitiveness,” Maybank's Mr Rosalie said.

“Monetary easing alone is unlikely to deliver meaningful growth momentum without these complementary measures,” he said.

Rizal Commercial Banking Corp. chief economist Michael Ricafort said the government's catch-up spending plans and other anti-corruption efforts are expected to boost growth in the first quarter.

“If anti-corruption measures and other related priority reforms that further raise governance standards are taken seriously, these will be the missing and remaining important catalysts that will help improve investor confidence,” Mr. Ricafort said.

Jonathan L. Reyes, Senior Counsel, Tacundong & Co. Ravelas said economic growth could increase to 5.6% in 2026 “if the government focuses on clean and timely spending, stronger infrastructure delivery, more predictable policy signals and real support for agriculture and small businesses.”

Bank of the Philippine Islands (BPI) chief economist Emilio S. Neri, Jr. said that if natural disasters reduce, the economy could see better figures in the second half of 2026.

“Of course, this was disappointing, because our potential growth is closer to 6% to 8%. It is necessary to improve the quality of public spending by banning all types of conflicts of interest to bring the economy back to its full potential,” Mr Neri said.

Economic managers expect GDP to grow by 5-6% this year.